AI

AI

AI

AI

UPDATED 12:28 EDT / APRIL 13 2024

AI

AI

Enterprises are fighting a dual mandate of operating inside a tight information technology budget envelope while at the same time transforming their organization into an AI-first company. Navigating macroeconomic headwinds while driving innovation is an exciting challenge for IT decision makers.

To deliver the goods, technology leaders are stealing from other budgets to fund artificial intelligence, finding quick wins with fairly unspectacular use cases and in some situations swinging for the fences with ambitious AI training initiatives. These more sophisticated efforts are designed either to drive revenue from things such as better advertising outcomes or to solve complex human problems such as new drug discovery, cancer research, autonomous driving and the like. The reality is, 16 months into the generative AI awakening, there’s lots of hype and tons of experimentation happening, but success in enterprise AI is far from assured.

In this week’s Breaking Analysis, we dig deep into the numbers and look at the macro spending climate, then drill into specific spending patterns around generative AI. We’ll look at how budgets are being funded, how gen AI return-on-investment expectations are changing, common use cases and large language model adoption. And we’ll close by asking the somewhat controversial question: Is it cheaper to do AI in the cloud or in on-premises data centers?

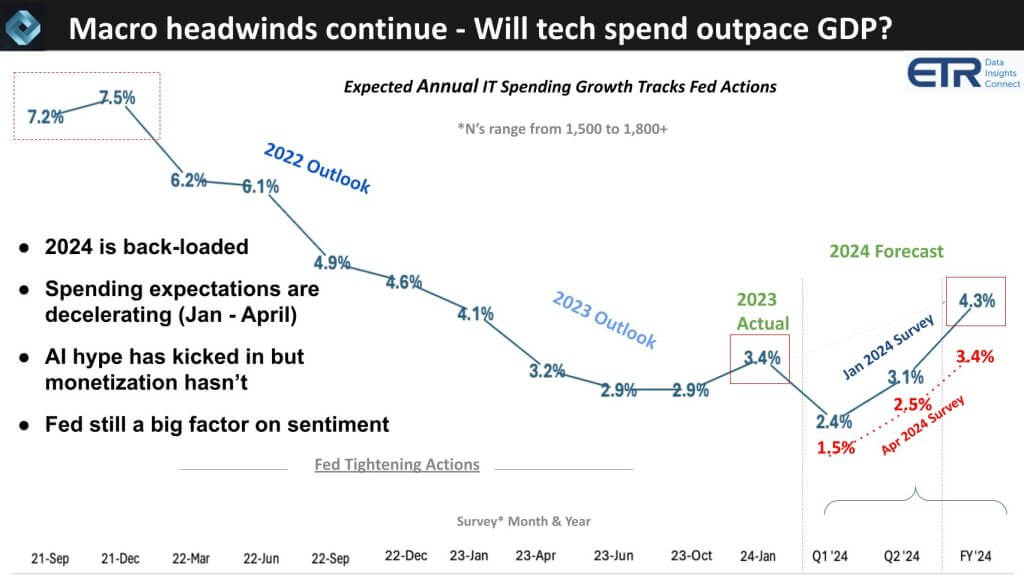

First, let’s look at how the sentiment on IT spending has changed in just a few short months. The chart below shows the results of twelve quarters of sampling IT decision makers’ forecast of annual enterprise tech spending. The Ns of these ITDM surveys consistently range between 1,500 and 1,800 with a very high overlap (around 75%) of repeat respondents. As we exited COVID and the Fed started tightening, spending growth expectations kept decelerating and finally bottomed when the Fed stopped tightening last summer.

Rob Williams, senior vice president of investor relations at Dell Technologies Inc., commented on this data, saying it probably tracks the two-year Treasury yield, and he’s absolutely right – it’s basically inversely proportional to that metric, meaning the rise in two-year yields corresponds to a deceleration in IT spend expectations.

The notable points here are:

We would expect IT spending to grow at least one to two points faster than gross domestic product. With the new consumer price index numbers this past week, we could see GDP growth expectations approach these tech spending forecasts. With the AI hype, you would like to see tech spending maintain a healthy growth rate above GDP. The reality is though AI hype is in full swing, AI monetization isn’t, and so the Fed remains a factor in determining sentiment and that is rippling into IT budgets.

Let’s look at how is AI being funded in many organizations.

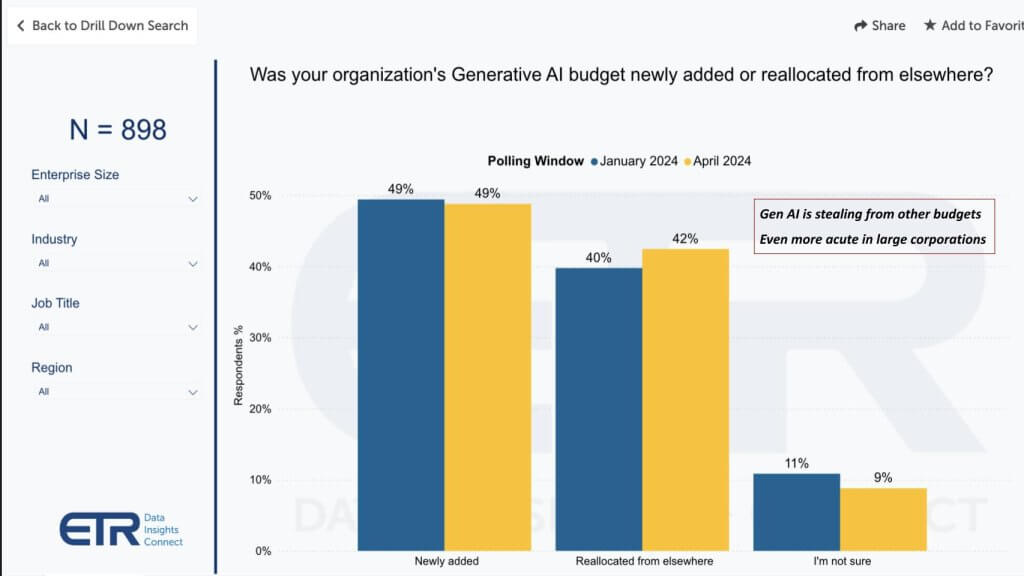

As we’ve indicated in previous episodes, this data above shows us that 42% of customers in a survey N of 898 say they’re stealing from other budgets to fund gen AI projects. When we dig into that data, money is coming from business apps, non-IT departments, productivity apps that gen AI could disrupt, other AI spend such as legacy machine learning, analytics and not surprisingly, legacy robotic process automation.

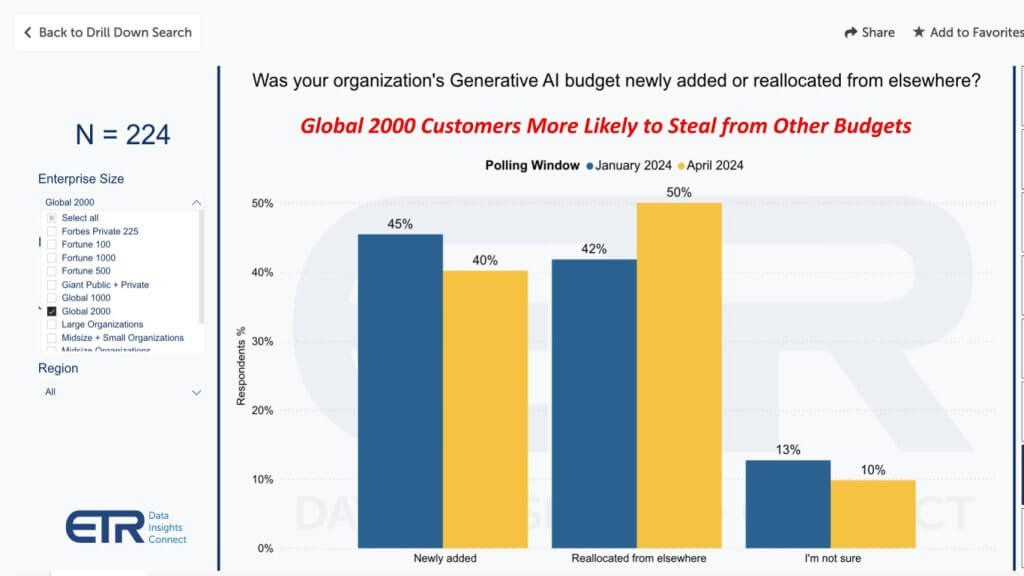

Remember this data represents percentage of customers, not budget amounts. But evaluating larger customers in the Global 2000 as a proxy for big spenders, the figure increases from 42% to 50% of customers stealing from other budgets. Moreover, the percentage of customers allocating new funding in this cohort drops to 40% versus 49% in the broader survey.

This data above represents results from 224 Global 2000 respondents, so at more than 10% of the G2000, it’s a pretty representative set of respondents.

The point is: Because of the macro climate and perhaps other factors we’ll discuss below, chief financial officers are not simply opening their checkbooks. Now, anecdotally, select CFOs tell us they are being very aggressive about AI spend – but we see that sentiment is much more narrowly applied. We’ll be interested to look back five to seven years from now to see how those aggressive companies are faring.

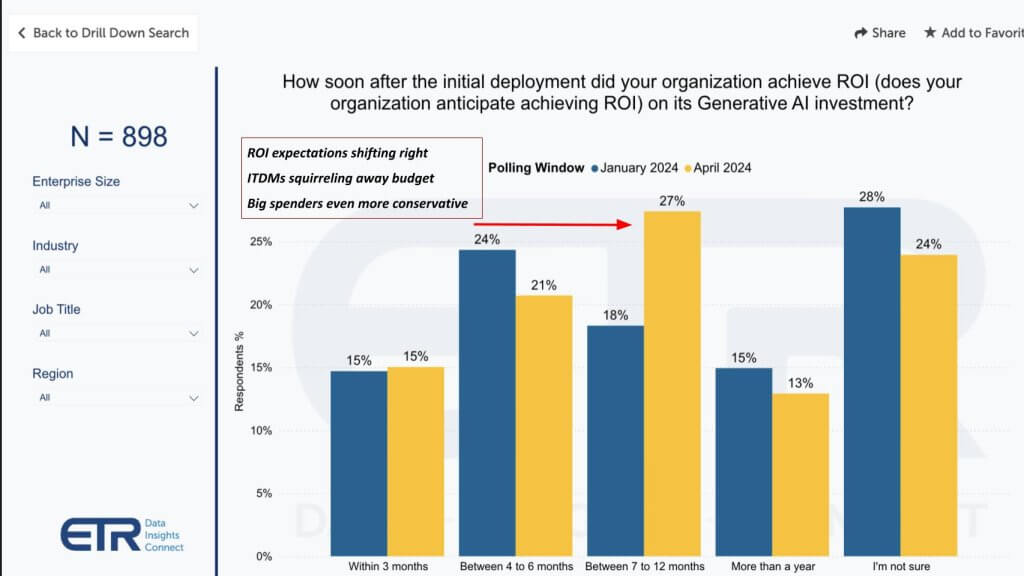

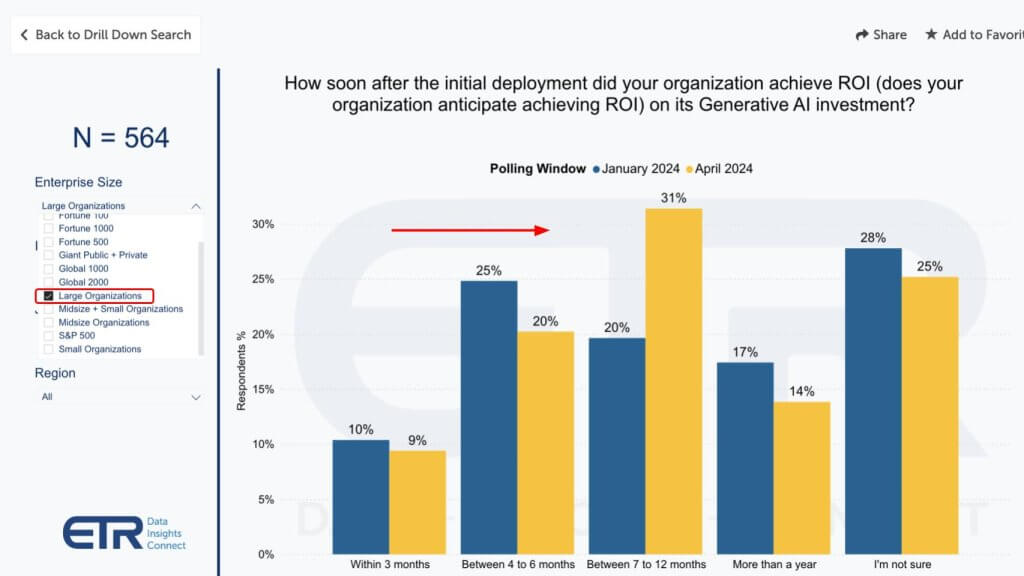

ROI expectations are becoming somewhat less aggressive. People naturally listen to the hype and think this AI stuff is easy – which in many cases it is – but it’s not as easy to drive measurable results to the point where you can throw off enough cash to fund future investments – not yet anyway. So ROI expectations are shifting to the right as shown on this chart below.

This means tech leaders are becoming less aggressive and signing up for a somewhat longer payback period. The norm is still inside 12 months for mainstream projects, but as you see, there’s also still uncertainty on ROI timelines, with 24% of customers citing they’re unsure. Those longer-term ROI timelines we discussed earlier will be in the more-than-a-year category, representing 13% of customers.

The other thing we hear in conversations with customers is ITDMs squirreling away some of this budget as they try to determine where to place their bets. But as the call-out notes, the big spenders at larger companies are even more conservative, as shown below.

And why not? Why sign up for a short ROI when you’re still experimenting with gen AI and basically applying ChatGPT-like use cases to your business?

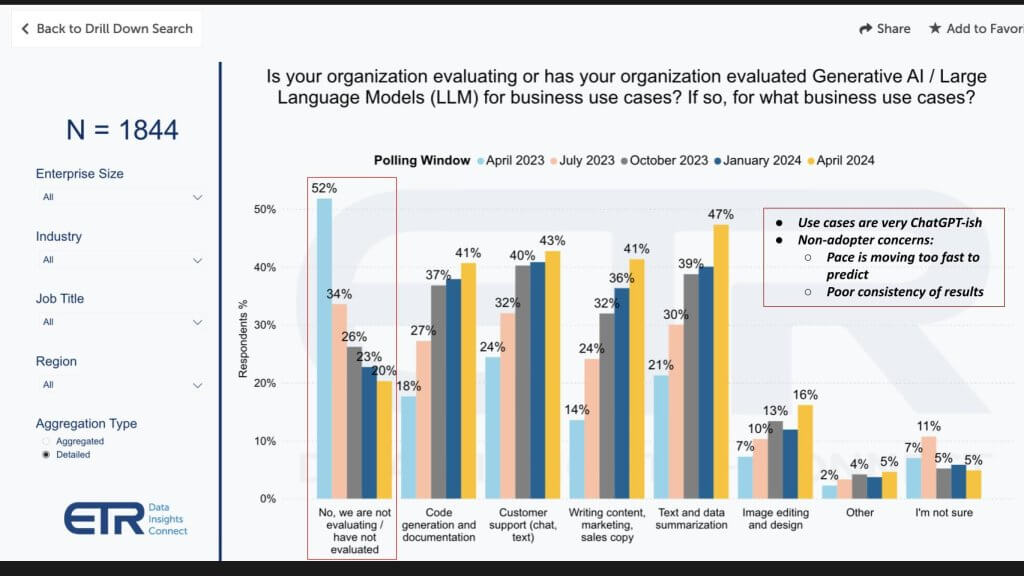

Below we show how gen AI is being used in 1,844 customer accounts. The use cases are not remarkable by any means. It’s what you’d expect with basically ChatGPT-like examples. Specifically:

Those other cases are expensive. They are training-intensive and require access to graphics processing units, which you’re going to get from either cloud providers or alternative GPU clouds such as CoreWeave, Genesis or Lambda and the like. Or you’re going to buy GPUs and do the work on-prem with GPU-powered servers from Dell, Hewlett Packard Enterprise Co., Lenovo Group Ltd., Supermicro or other original design manufacturers. But for folks wanting to do serious training directly buying GPUs from Nvidia Corp., if you’re not willing to commit to spending $10 million, there’s a good chance you’re going to wait in line for over a year to get some.

The other callout on this data is highlighted on the left in red. It shows the percentage of customers who say they’re not evaluating gen AI and LLMs. Surprised? So were we. And though the number has come down rapidly, in looking into this, we’ve confirmed it’s true. It’s not necessarily that there’s no gen AI happening at the company, but there are a number of folks we’ve talked to that say it’s too complicated and moving too fast right now to pick winners, so they’re waiting for the storm to subside and they’ll learn from others’ mistakes. The other thing we’ve heard is shown in the insert: Folks just don’t trust the models right now because the results are unpredictable and it’s too risky.

To both of these, we’d say at the very least you need to start thinking about your AI platform organization and architecture. AI is going to force changes to how you serve customers. The way you support your general-purpose workloads of CRM, ERP and collaboration software today won’t necessarily directly translate to AI.

We advise thinking about your AI platform and how to construct that. You’re likely a hybrid shop today, so how do you evolve that into hybrid AI with a combination of cloud and on-prem? And how are you rethinking your data strategy to support AI by unifying metadata, rationalizing disparate data types with semantics and so forth?

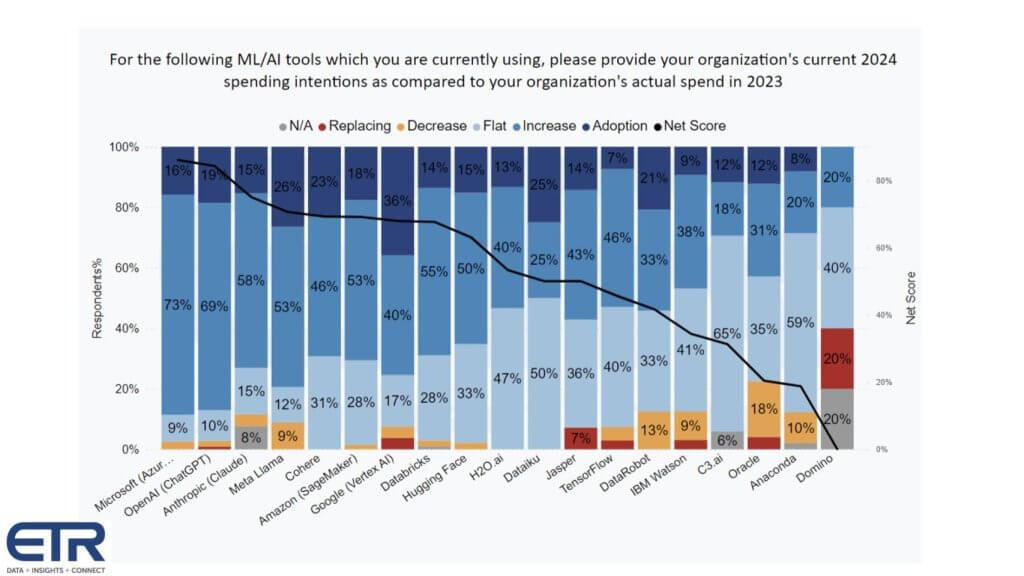

We agree, innovation is moving fast and there are many choices. It’s hard to keep up. Below is some data from Enterprise Technology Research on AI tools adoption by vendor and platform.

It shows for each AI vendor, the percentage of customers in the latest survey: 1) Adopting the platform new – that’s the dark blue; 2) Investing more in the light blue; 3) Flat spend in the powder blue; 4) Decreasing spend in the orange; 5) And churning in the red. Subtract the orange and the red from the dark and lighter blues and you get Net Score, which is that dark blue line. Note that anything above a 40% Net Score is considered exceedingly high.

What this data is telling us is:

IBM Corp. is interesting to us because for the first time in a long time, we’re really excited about IBM’s AI business. The data is not as friendly here and we suspect it’s because IBM is still cycling through old Watson and ramping watsonx with corresponding services around data, governance and the like. But IBM is definitely in the game, as is Oracle Corp.

We sympathize with the complexity of the situation right now. As an example, Databricks announces DBRX touting benchmarks of an MoE model that beats Mixtral then Mistral AI counters with a new high-water mark. And Amazon ups its investments in Anthropic but it’s building Olympus, an internal foundation model that they want to make better than Anthropic’s Claude. Then Microsoft does an acqhire of Inflection… so yeah, it’s complicated.

But the way to prepare is to think about the architecture that serves your business and build your own system that fits your needs. That may mean focusing primarily on processes and people versus technology, which is fine, but there will be an underlying technology architecture that at some point you’ll have to leverage to compete. So you want to be thinking about that now. And bringing in the expertise and partnerships to help you build it for your purposes.

OK the last thing we’re going to talk about is cost of cloud versus on-prem. And indirectly, inferencing versus training. Everyone is debating this. The cloud platforms are moving fast and, let’s face it, that’s where most of the action is, with Microsoft pulling off the OpenAI coup, forcing both Google and AWS to respond with their internal “code reds.”

The GPU clouds we talked about earlier are popping up and raising lots of venture money while Meta is throwing its open-source weight around with Llama. The hyperscalers are winning the capital spending wars because they are swimming in cash and so they’re buying as many GPUs as they can. At the same time, they’re building their own silicon.

But then at at GTC, Michael Dell got a call-out from Jensen that nobody is better at building end to end systems than Dell. Because Dell has by far the most comprehensive end-to-end portfolio of anyone, from laptops to high end servers. But how do you think HPE, Lenovo and Supermicro feel about that? So HPE just announced that Jensen will be speaking at the Sphere with CEO Antonio Neri at HPE Discover.

And so it goes…

The reason we bring this up is all this jockeying for position is adding to the confusion. The cloud players are saying, “Come to us, we have optionality, tools, innovation and scale.” The alternative GPU clouds are saying that they have purpose-built services for the AI era that is more cost-effective and a better strategic fit for AI. And the on-prem players say, “You’re going to spend a lot of money in the cloud, come to us.”

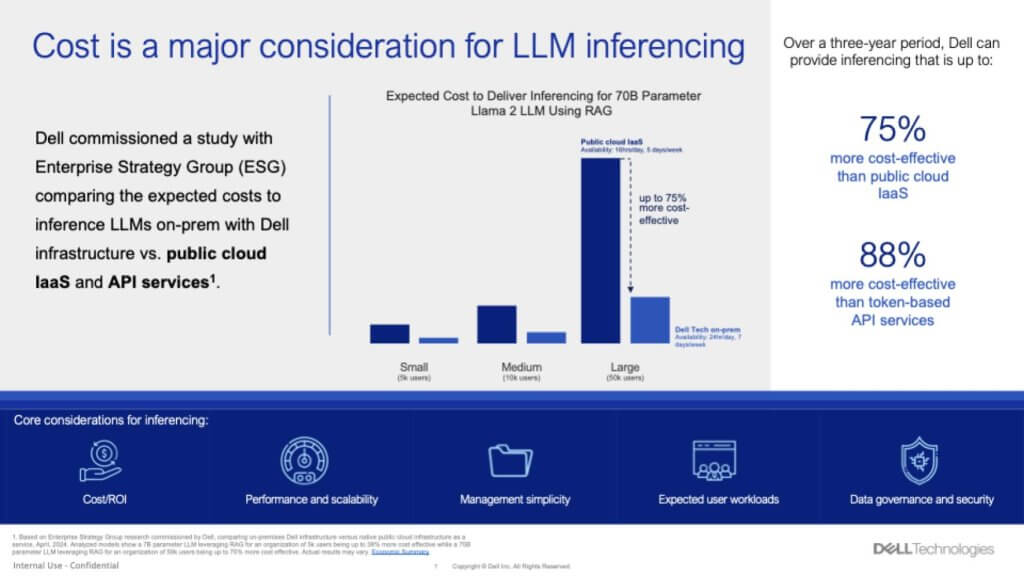

So we’ve got ahold of some data that we found eye-catching.

It’s data from a study commissioned by Dell and conducted by ESG. You have to be warned this was a paid-for study and you know how these things are used in marketing. But the person who led the study, Aviv Kaufmann, is well-respected, and from what we’re told – not by Dell but others who know him – he would not compromise his ethics and has a strong engineering background.

Cutting to the chase – just to add more fear, uncertainty and doubt into the conversation – this data shows that doing inference on-prem for a 70 billion-parameter Llama 2 LLM using retrieval-augmented generation is far cheaper on-prem than in the cloud. And the two points in the call-out are: 1) If you’re driving your RAG via token-based API services from the likes of OpenAI, you’re going to pay a price over doing your own RAG on-prem with open source models; and 2) RAG is not that hard to do. And doing RAG-based workloads with Dell-powered GPU servers is more cost-effective than using infrastructure as a service on AWS or other clouds.

Now, we love the back and forth, whether it’s benchmarketing or total-cost-of-ownership wars. So the first thing AWS is going to point to is it would run this model differently using its custom chips. That is, AWS would say, “If you want lower-cost inference, you should use our custom Inferentia chips.” Of course you can only get them in the AWS cloud. Dell doesn’t make its own chips. And the back-and-forth continues.

The point is this is one of those “it depends” moments. Cloud company A will tell you it’s much less expensive to do IT in the cloud than on-prem with all that heavy lifting, and the on-prem guys will say, “That may have been true in 2010, but we’ve replicated the cloud operating model on-prem,” and the debate goes on. It may very well be more expensive sometimes to do work in the cloud, but oftentimes the developers in an organization are so in love with their cloud, it’s worth it. Or the access to new services or innovations in the cloud is often better.

At the same time, cloud bills are sometimes very expensive and unpredictable. Moreover, the data you want to use for your AI may not be in the cloud, so in all likelihood, while the cloud is and will likely continue to grow faster than on-prem, most customers are living in a hybrid IT environment and that will extend to hybrid AI.

But we’d like to speak with Aviv and learn more about this study, so we’ll reach out to him and hope he’ll talk.

Let’s leave with a few thoughts on some of the things we’re paying attention to around enterprise AI adoption.

Despite all the confusion, one thing is clear: The big money in AI right now is in superchips, big memories, fast interconnects and training. Business-to-consumer use cases are no-brainers for AI because the bigger the AI cluster you can build, the better AI and ad targeting you’ll have.

But those big complex problems in healthcare, climate and the like have long investment horizons and will take time to pay back. They may not see ROI for a decade. They are training-intensive, so the demand for big GPUs is here to stay, in our view. Nvidia has a monopoly in super-GPUs and will hold its serve for the better part of a decade, in our opinion.

Mainstream enterprise use cases are focused on productivity and quick hits that are very ChatGPT-ish in nature. Document summarization, ideation, code generation and so on. These are nice but in and of themselves will not transform industries.

RAG is not that hard to do. And it allows domain-specific inferencing. There are lots of experiments going on with RAG today, but the big money use cases are not easy to find. They’re fun. They’re cool. But cost is going to be a factor here.

Low-cost inferencing at the edge is going to be the dominant AI use case, in our view. It won’t necessarily create monopolies, but there will be a lot of it. And as we’ve said for years, it will be based on the Arm standard.

And finally, forward-thinking chief technology officers and this emerging role of an AI architect are envisioning new platform strategies. Waiting for the storm to clear may not be the best approach with respect to architecture. There are some knowns such as the type of workload patterns AI requires and how training and inference work may have unique requirements. And much of this is about governance, data quality and other corporate edicts. These decision points should be ongoing and iterative with platform, not product, thinking.

Cost will come into play. It always does. Remember the math on ROI is really simple. Benefit divided by cost. So what happens when you drive the denominator toward zero? The result goes to infinity. But the size of the benefit matters too. So a 1000% ROI on a project with a $100 net present value isn’t nearly as interesting as a 12% IRR on a billion-dollar NPV. But if it takes 10 years to get a payback… a lot can change in 10 years.

Confused about what do to with AI? You’re not alone, so think about the people and process effects and the dramatic change in business process that AI can bring. Then get going on architecture, platforms, iterative development and learnings from experiments. But don’t stick your head in the sand and hope to figure it out down the road, or your company may be out of business.

What do you think? Does this data we shared reflect what’s happening at your organization? Do you have it all figured out or are you struggling to keep up? Where are you placing your AI bets and how are you funding them?

Let us know.

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU

UK antitrust watchdog opens probe into HPE’s $14B Juniper acquisition

The deepening partnership between HPE and Nvidia: analysis from HPE Discover 2024

Pure Storage adds AI features to improve performance and detect attacks

Finbourne raises £55M to break down financial data silos with AI

Amazon’s first labor union partners with the Teamsters

Decagon raises $35M to transform customer service with more 'humanlike' AI agents

UK antitrust watchdog opens probe into HPE’s $14B Juniper acquisition

INFRA - BY MARIA DEUTSCHER . 31 MINS AGO

The deepening partnership between HPE and Nvidia: analysis from HPE Discover 2024

INFRA - BY VICTOR DABRINZE . 2 HOURS AGO

Pure Storage adds AI features to improve performance and detect attacks

INFRA - BY PAUL GILLIN . 6 HOURS AGO

Finbourne raises £55M to break down financial data silos with AI

BIG DATA - BY MIKE WHEATLEY . 17 HOURS AGO

Amazon’s first labor union partners with the Teamsters

POLICY - BY JAMES FARRELL . 17 HOURS AGO