AI

AI

AI

AI

AI

AI

In another big week, we saw the artificial intelligence battles continue to escalate.

Google LLC reorganized to better focus on AI, Meta Platforms Inc.’s Llama 3 was released, Taiwan Semiconductor Manufacturing Co. is doubling its manufacturing capacity for Nvidia Corp. high-end chips, Samsung Electronics Co. Ltd. got a $6.4 billion tranche of the chips act money, a Microsoft Corp. paper describes VASA-1 that turns photos into a kinda creepy talking head, Mistral AI is doing a half-billion-dollar raise at more than twice its last valuation from just four months ago and SAS Institute Inc. introduced industry models in a sign that demand for domain-specific AI is taking shape.

Since the AI awakening in November 2022, the spending climate for enterprise tech has transformed. Customers are scraping money from other budgets to fund AI and running experiments in the desperate race for monetization. Names that were virtually unknown in early 2022 – such as OpenAI, Meta Llama and Anthropic PBC, are vying with the cloud-scale companies to get a piece of the pie. And notably, based on the latest Enterprise Technology Research survey data, though Google remains a distant third in cloud computing spend overall, it has dramatically accelerated its position in the all-important AI sector, closing the gap with Amazon Web Services Inc.

In this abbreviated Breaking Analysis, we’ll show you how the spending patterns have changed since early 2022, prior to the launch of ChatGPT, and we’ll share where customers are putting their bets on AI platforms.

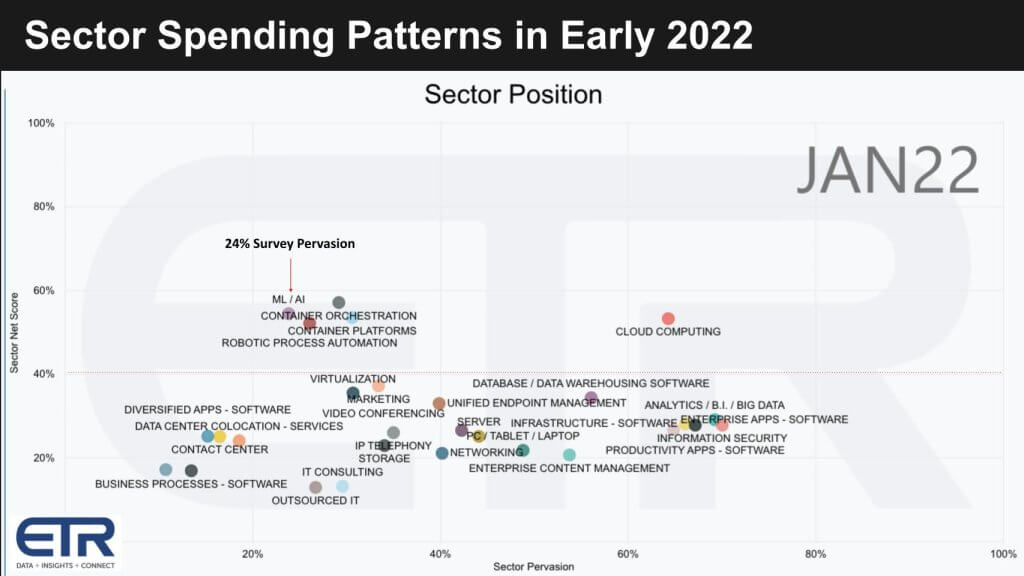

Let’s take a look back at the spending climate in 2022. The chart below shows Net Score or spending momentum on the vertical axis. The horizontal axis is Pervasion, which represents the number of customers spending in specific sector divided by the total N in the survey of around 1,800 IT decision makers. That red line at 40% on the vertical axis represents a highly elevated Net Score.

The following key points are important:

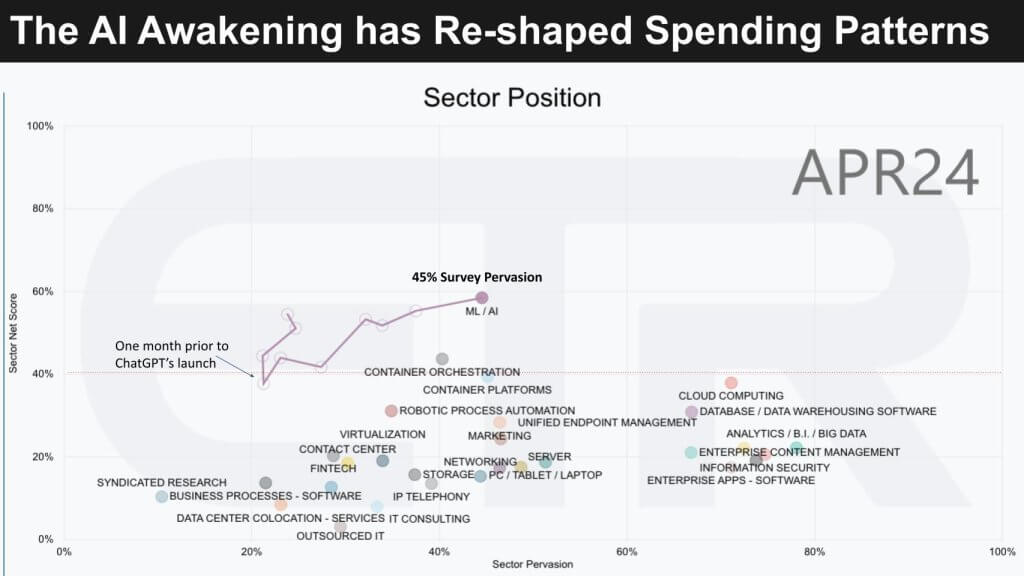

When we fast forward to 2024 the picture changes dramatically with ML/AI momentum outpacing other sectors and nearly doubling its account pervasiveness.

Here are the key takeaways:

As we’ve reported, AI is stealing budget from other sectors of the tech economy. And generally the monetization hasn’t been there or at least not to the point where it’s causing the overall spending climate to grow. In fact, just the opposite is happening, that is, the spending outlook remains challenging overall. So until AI projects start to throw off enough cash to pay for themselves or other initiatives, we expect the macro to be challenging.

Let’s take a look at how spending on various AI platforms has changed in the last two years.

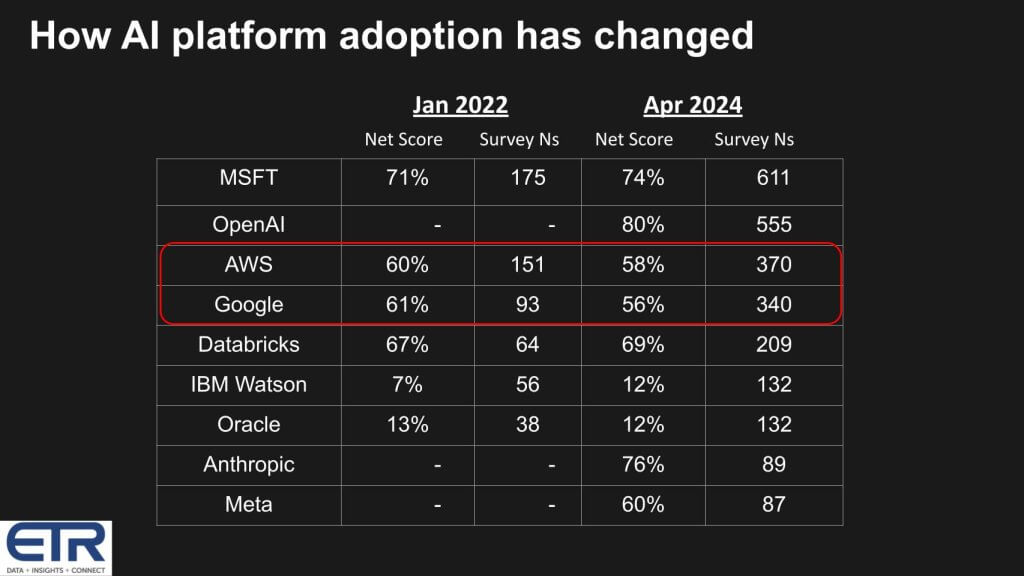

In the table above we look at AI adoption by platform vendor over the past two years. We have synthesized data from two pivotal points in the ETR surveys: one from January 2022 and a subsequent snapshot from April 2024. For each time period we show Net Score and the number of respondents citing they’re using a specific platform (Ns).

Net Score methodology: ETR’s proprietary Net Score metric is captured each quarter in a time series. It is an indicator of the proportion of customers increasing their investment in a given AI platform. This metric is the result of a subtraction process where the percentage of customers curtailing their spending or disengaging from the platform is deducted from those intensifying their investments or commencing new engagements.

Key observations:

Consolidated insights:

Bottom line: The AI sector is in the throes of an accelerated evolution but uncertainty remains. Our research indicates that as AI continues to mature, it will become more entrenched with various existing technology sectors. Spending patterns are becoming increasingly dynamic and will likely be volatile as return on investment is still elusive in many accounts.

We see this wave as not merely a transition but a transformation, and believe that customers must remain agile with a platform mindset to navigate the changing landscape of AI. Specifically, we believe customers must develop an internal architecture that is people and process focused with requisite change management protocols. Customers must be able to quickly test, prove and adopt new technologies and innovations as they hit the market. Given the high levels of funding and capital spending investments, the market is likely to remain highly competitive with dizzying optionality.

A platform mindset will allow firms to optimize for specific use cases based on the performance, cost, energy and time to value requirements specific to their organizational edicts. AI spending momentum and penetration from the survey data will continue to serve as a barometer for innovation and market position in the foreseeable future.

Watch the full video analysis:

THANK YOU