CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

You won’t find any trace of the words “hybrid” and “multicloud” in Amazon Web Services Inc.’s official discourse, but several key announcements made at its re:Invent conference this month suggest it sees those trends as the next big opportunity to expand its reach into the enterprise.

In his latest Breaking Analysis video, Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE’s video studio theCUBE, sat down with co-analyst Stu Miniman to conduct a post-mortem on re:Invent. The pair discussed the latest spending data from Enterprise Technology Research to put demand for AWS services in context, as well as the expansion of AWS’ Outposts portfolio, which is likely to form the basis of its hybrid, edge and perhaps even its multicloud strategies.

Words matter greatly to AWS. Chief Executive Andy Jassy uses the term “0n-premises” in a way many use the term “hybrid.” However, AWS is dogmatic about the nature of its on-premises offerings in that the systems it installs at customer data centers have identical attributes (in hardware and software) as those found in AWS’ public cloud.

The company views multicloud as customers accessing multiple public clouds and excludes on-premises infrastructure in that definition. As seen at this year’s re:Invent, AWS continues to expand its on-premises offerings and is not currently participating directly in the business of managing multiple public clouds.

Regardless of terminology, AWS is attacking hybrid cloud and multicloud from a position of strength. ETR’s latest figures show that planned spending on AWS services remains largely immune to the recent trend that has seen enterprises moderate IT spending to pre-2018 levels.

ETR’s data provides “net scores” for AWS across several of its most important market segments, including cloud overall, analytics databases, machine learning and artificial intelligence, and workspaces. Net scores from ETR are an important metric because they’re a simple but effective way to gauge spending momentum on a specific company, by essentially subtracting the percentage of customers spending less from those spending more.

“AWS is bucking the trend,” Vellante said. “It’s gaining momentum in most of its segments relative to a year ago. So even though IT spending overall is softening, AWS is doing better than many of its peers.”

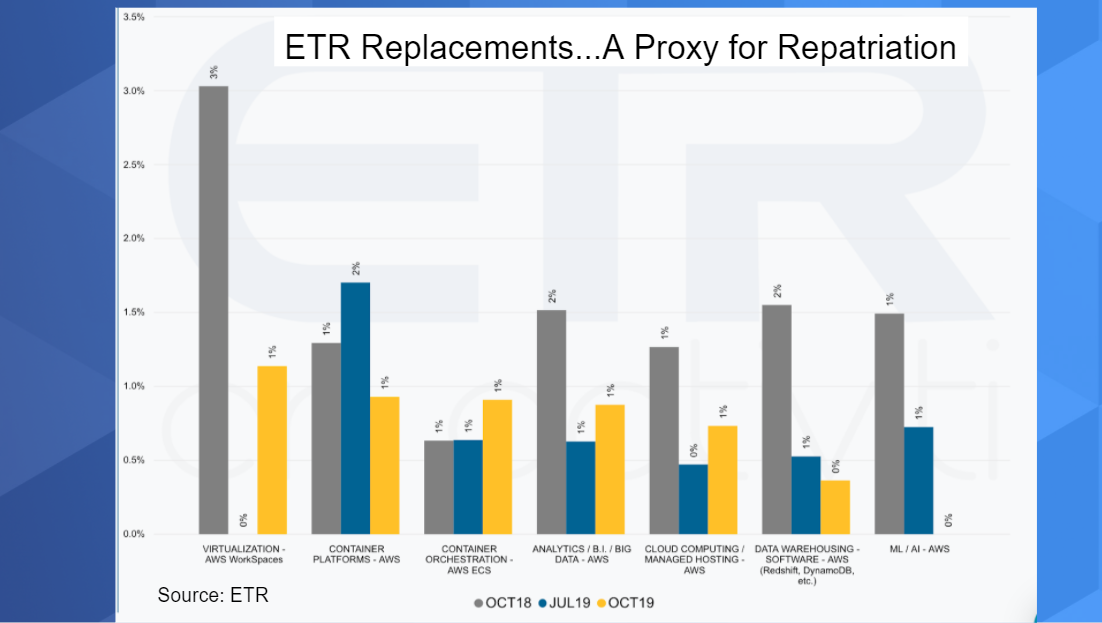

Further evidence of Amazon’s strength comes from its ability to retain customers at a time when many in the industry report that organizations are moving certain workloads back on-premises because the cloud is too expensive. According to Vellante, many of AWS’ competitors claim that customers are feeling “cloud remorse” and are repatriating workloads away from the public cloud and back to their own data centers. That may or may not be true for others, but in the case of AWS, at least, the number of customers exiting its cloud remains negligible.

“What this data shows is across AWS offerings, the percent of customers replacing AWS, which is a proxy for repatriation,” Vellante said. “Look at the numbers, they’re low single digits. Traditional enterprise vendors grow their entire business at single digits or many are shrinking. But AWS defections are in the low single digits.”

One of the main reasons for AWS’s continued pervasiveness is its willingness, despite not admitting it in so many words, to embrace the trend among enterprises towards hybrid cloud. According to Vellante and Miniman, we’ve seen this over the years in the form of a number of AWS offerings such as Snowball, Greengrass, its VMware partnership and most recently the expansion of its Outposts systems.

Multicloud, according to the analysts, is another story but they say you shouldn’t count AWS out of that business. Over time, they believe, if demand warrants, AWS will explore managing data across multiple clouds.

Vellante explained that Amazon doesn’t like to use conventional words such as hybrid and multicloud mainly because it has a different philosophy. Because of its dominant position, AWS sees itself as being at the center of what its customers are doing. It views a single cloud, for example, as simpler, more cost effective and more secure.

According to Vellante, AWS doesn’t believe hybrid can comprise different hardware, software and control planes between on-premises and public cloud locations. Rather, it believes in infrastructure homogeneity. However, AWS does understand that enterprises want to connect and manage on-premises infrastructure in a manner identical to the way they manage and protect public cloud workloads.

One of Amazon’s tactics to ensure it remains at the center of customer’s cloud strategies has been to push Kubernetes, the popular open-source orchestration software that’s used to manage software containers. With Kubernetes and software containers, it’s possible to build modern applications that can run on any kind of computing infrastructure, which means they can be moved across various public clouds or on-premises very easily. In theory Kubernetes and containers threaten AWS’ single cloud approach, however AWS has responded by embracing containers.

According to Miniman, his conversations with customers reveal that a great many of them who are doing Kubernetes in the public cloud are doing it on AWS. “It’s a viable hedge on your AWS strategy,” he said. “One of the main reasons they’re doing it is so they can hedge their bets against being all-in on Amazon.” But according to Vellante, because AWS has the best infrastructure cloud, customers want to run their workloads on Amazon.

Amazon’s hybrid and edge offering was extended with its forthcoming integrated data-center hardware product, AWS Outposts. The product was announced last year but released into general availability at re:Invent 2019, making it one of the big topics of conversation at re:Invent 2019.

AWS Outposts is essentially an on-premises data center system that will be an extension of VMware Cloud on AWS or a native AWS cloud environment. With AWS Outposts, cloud customers will have the option to run the AWS cloud on-premises. The hardware will come with fully managed and configurable compute and storage racks that can connect to Amazon’s public cloud.

It’s somewhat similar to Microsoft Corp.’s Azure Stack offering, which enables companies to run Microsoft Azure Cloud services in their own data centers. The difference is that Azure Stack comprises multiple vendor hardware offerings and is less homogenous in theory than Outposts.

Amazon has had the benefit of hindsight from Microsoft’s experience with Azure Stack, which has struggled to gain traction outside a few government agencies and service providers, Miniman told Vellante.

“Azure Stack… has not been doing phenomenally well,” Miniman said. “When I was at Microsoft Ignite earlier this year, I heard people are basically using it to deliver Azure as a service. Basically it’s an availability zone inside your data center, and Amazon has looked at this and says, ‘That’s not how we’re going to build this.’”

Instead, AWS extended Outposts as an extension of a local region that enables “Amazon as a service” in your local data center, Miniman said.

“It’s the Amazon hardware, the Amazon software, the Amazon control plane, reaching into that data center, and it’s very scalable, Miniman said. “Amazon says over time it should be able to go to thousands of racks if you need, so absolutely [it brings] that cloud experience closer to my environment, where I need certain applications, certain latency, certain pieces of data that I need to store there.”

One of the more notable announcements at re:Invent 2019 was Wavelength, an offering to embed Outposts within the 5G networks of service providers to deliver low latency services to customers. Initially the offering will be available in Verizon networks starting next year.

Vellante said he likes Amazon’s edge strategy better than some others he has seen in the market because it’s a “bottom-up” approach toward innovation. According to Vellante, “the edge will be one by developers. I see a lot of companies taking a top down approach, throwing boxes over the fence to the edge as a way to just sell more compute. What Amazon is doing is bringing its cloud stack to the edge and giving developers a programmable infrastructure platform to create new applications for edge and IoT workloads.”

Here’s Vellante and Miniman’s full analysis:

THANK YOU