CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Data protection company Veeam Software Inc. is poised to make a big push into U.S. markets after its $5 billion acquisition last week by the private equity firm Insight Partners.

The acquisition is likely to have big implications for both the company and the wider data protection market.

For one thing, Insight is not the typical private equity firm that exists simply to squeeze every last dollar out of its investments. It’s also a venture capital firm too, and that means it won’t be shy about throwing money at the business with the goal of getting to an initial public offering of stock and a very profitable exit.

More importantly, the acquisition ushers in a change of leadership at Veeam too, with co-founder and Chief Executive Officer Andrei Baronov stepping down. He will be replaced by William Largent, the former executive vice president of operations, and Danny Allan will step in as new chief product officer.

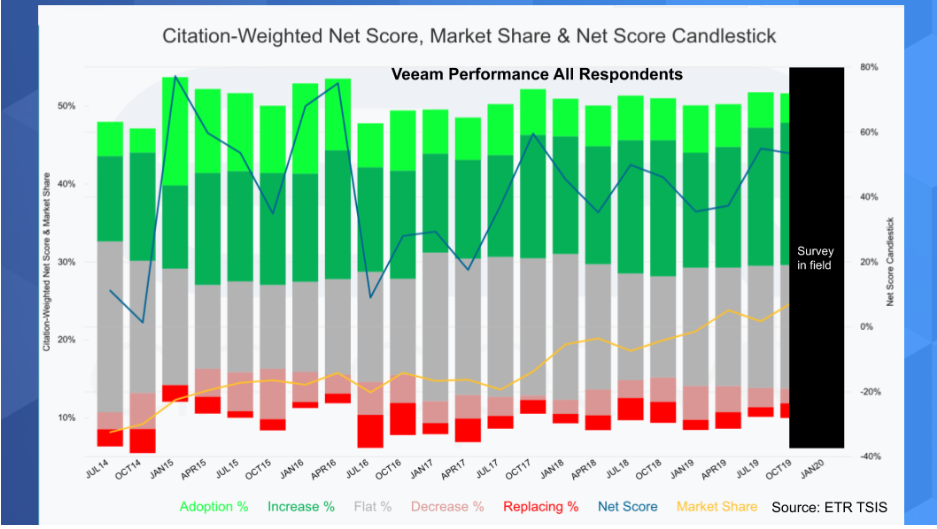

In his latest Breaking Analysis video, Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE’s video studio theCUBE, said Veeam is looking pretty healthy right now. He noted that it’s one of the few players in a crowded data protection market that’s actually gaining market share, though the latest data from Enterprise Technology Research suggests it still has work to do if it’s to get a foot in the door at larger enterprises.

The ETR data shows that Veeam has done well in terms of market share over the last couple of years, maintaining a range of 30% to 40%. (ETR’s “market share” is a measure of pervasiveness in its spending surveys.) The company also boasts a strong “Net Score,” which is a measure of spending momentum on a specific company that works by subtracting the percentage of customers spending less from those spending more on a specific provider.

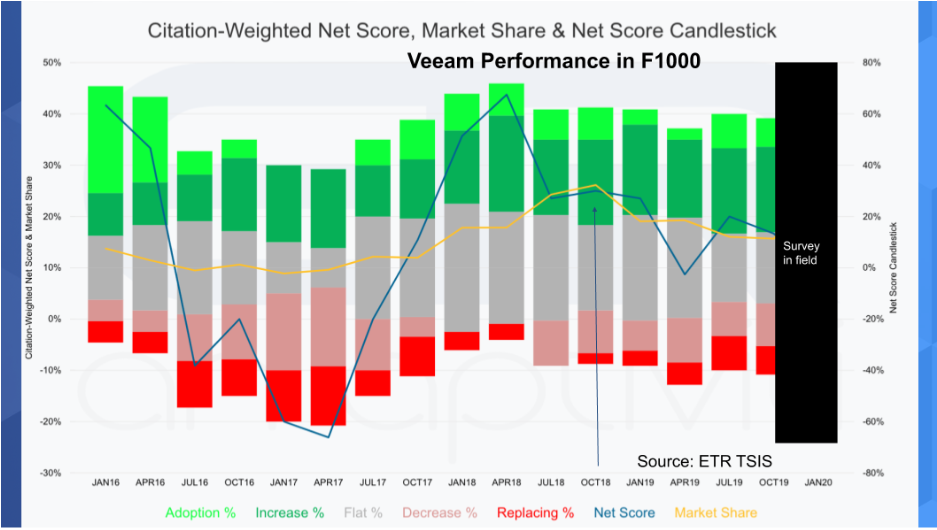

That’s all well and good, but the ETR data looks less convincing when Veeam’s performance is isolated in terms of the largest enterprise companies.

“The picture is much choppier,” Vellante said. “Market share is OK, but it’s not steady. Former CEO Peter McKay, who was brought in to penetrate larger companies, left in October 2018 and that’s when Veeam pulled back on its big enterprise push. You can see the noticeable and steady drop there.”

One of the most pressing challenges for Veeam going forward will be its push into multicloud. The company’s data protection products were originally designed for Windows-based architectures, but more recently the market is all about the cloud. And unlike many of its rivals, Veeam’s transition to the cloud has gone relatively smoothly.

“When Veeam added cloud backup it was a very good product, unlike many products when they first tried to port to the cloud,” Vellante said. “Recovery from the cloud is tricky because things are usually out of sync and that creates a metadata challenge. But Veeam has generally been able to achieve a consistent level of performance with its cloud product.”

The problem for Veeam now is that most modern information technology architectures these days are based on Linux, not Windows. And that means that as Veeam attempts to become relevant in an increasingly multicloud world, it’s going to have to do a lot more interfacing with Linux-based systems. It will need to migrate a lot more code, and that will make maintaining consistent performance all the more challenging, Vellante said.

Notably, Veeam’s native cloud service is built on Linux but as it relates to hybrid and on-premises deployments, Veeam will have to demonstrate that it can maintain its consistent product excellence when connecting its two platforms.

A second big challenge for Veeam will be its execution in the U.S., particularly among the large enterprises it’s courting there.

“If I’m an enterprise customer I’d be pressing Veeam on its roadmap and having them clarify their vision around hybrid and multi-cloud management,” Vellante said.

It also remains to be seen how the new leadership will affect the company and its culture. In his analysis, Vellante said he’s a big fan of founder-led companies, as company founders tend to be intensely committed to the cause.

Examples include Michael Dell at Dell Technologies Inc. and Larry Ellison at Oracle Corp., who have gone to great lengths to get their companies where they are today. He said there’s a stark difference between the likes of them and “nonfounders” such as Joe Tucci, who successfully led EMC Corp. as its CEO for years but was only too happy to step out once Dell provided an option to buy the company.

“For me the bottom line is the big opportunity is in the U.S.,” Vellante said. “That’s about execution and I expect consistent market share gains to continue. The enterprise will take longer, more patience and more money. With Veeam transitioning from essentially the two founders’ lifestyle business into a company built for an exit, it’ll have more money to invest, greater transparency and a path to build on their past successes.”

Here’s Vellante’s full analysis:

THANK YOU