AI

AI

AI

AI

AI

AI

Nvidia Corp. wants to transform enterprise computing completely by making data centers run 10 times faster at one-10th the cost.

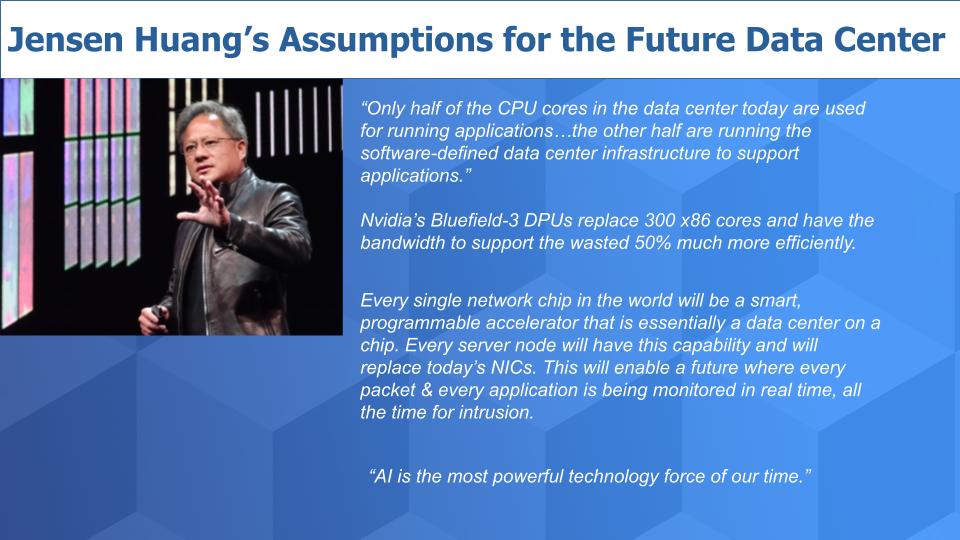

Nvidia Chief Executive Jensen Huang (pictured) is crafting a strategy to re-architect today’s on-premises data centers, public clouds and edge computing installations with a vision that leverages the company’s strong position in artificial intelligence architectures. The keys to this end-to-end strategy include a clarity of vision, massive chip design skills, new Arm-based architectures that integrate memory, processors, I/O and networking, and a compelling software consumption model.

Even if Nvidia is unsuccessful at acquiring Arm Ltd., we believe it will still be able to execute on this strategy by actively participating in the Arm ecosystem. However, if its attempt to acquire Arm is successful, we believe it will transform Nvidia from the world’s most valuable chip company into the world’s most valuable supplier of integrated computing architectures.

In this Breaking Analysis we’ll explain why we believe Nvidia is in a strong position to power the world’s computing centers and how it plans to disrupt the grip that Intel Corp. x86 architectures have had on the datacenter market for decades. We’ll also share some Enterprise Technology Research data that will put AI spending and the competitive dynamics in context.

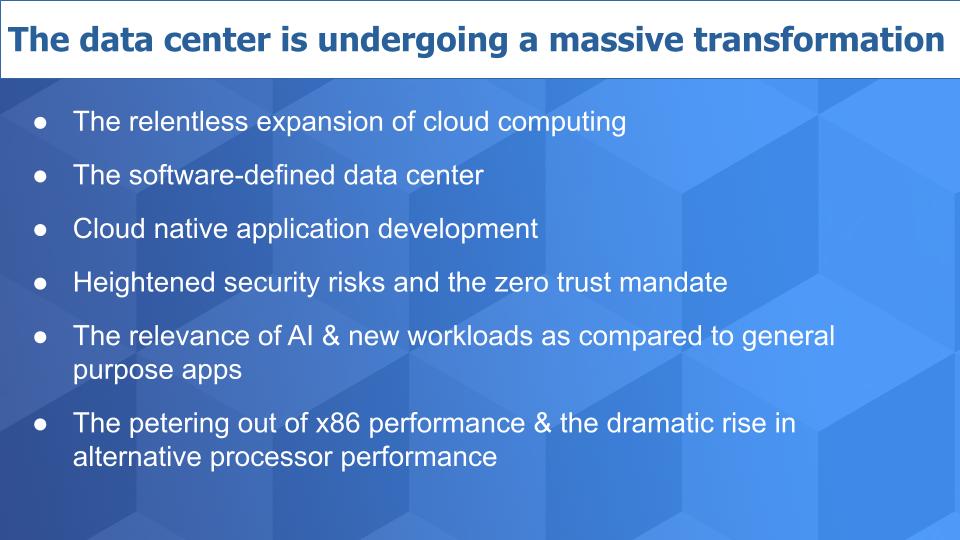

There is only a handful of megaclouds, but there are lots of data centers. Even though the number of data centers worldwide is consolidating, there are still more than 7 million, according to IDC. The cloud, like the universe, is expanding at an accelerated pace and millions of data centers are being interconnected via the internet – the world’s new, (not so) private network. This new cloud is becoming hyperdistributed and run by software.

Open application programming interfaces, external applications, sprawling digital supply chains and this expanding cloud increase the threat surface and vulnerability to the most sensitive information that resides within data centers around the world. Zero trust has gone from buzzword to mandate seemingly overnight.

We’re also seeing AI injected into every application and it’s the technology area we see with the most momentum coming out of the pandemic. We believe the architectures that are powering AI will be the linchpin of Nvidia’s strong entry into the datacenter market.

To wit, we believe this new world will not be solely powered by general-purpose x86 central processing units. Rather it will be supported by an ecosystem of Arm-based providers that are affecting an unprecedented increase in processor performance.

Nvidia in our view is sitting in the pole position and is currently the favorite to dominate the next era of computing architecture for global data centers, public clouds as well as the near and far edge.

Below is a graphic that underscores some of the fundamental assumptions Nvidia’s CEO is banking on to expand his market. The first is that there’s lots of waste in the data center. He claims that only half the CPU cores deployed in the data center today actually support applications. The other half are processing the infrastructure around the applications that run the software-defined data center. And they’re terribly underutilized.

Nvidia’s Bluefield-3 DPU, or data processing unit, was described in a blog post by analyst Zeus Kerravala as a complete mini-server on a card with software-defined networking, storage and security acceleration built in. This product has the bandwidth, according to Nvidia, to replace 300 general-purpose x86 cores.

Jensen believes that every network chip will eventually be intelligent, programmable and capable of this type of acceleration to offload compute from conventional CPUs. He believes that every server node will have this capability and enable every packet and every application to be monitored in real time, all the time, for intrusion. And as servers move to the edge, Bluefield will be included as a core component. He claims 25 million servers are shipped each year, and that’s his target.

That last statement by Jensen is critical in our view: “AI is the most powerful force of our time.” And whether you agree with that or not, it’s relevant because AI is everywhere and Nvidia’s position in AI and the architectures the company is building are the fundamental linchpin of its data center and enterprise strategy.

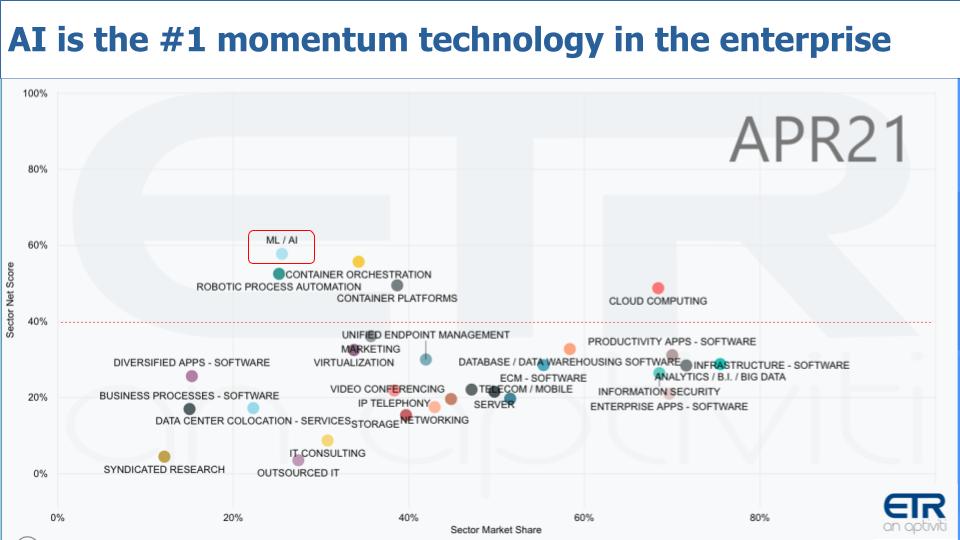

Let’s take a look at the ETR data to see where AI fits on the chief information officer priority list. Below is a set of data in a view we often like to share. The horizontal axis is Market Share or pervasiveness in the ETR data. But we want to call your attention to the vertical axis, which is Net Score or spending velocity.

Exiting the pandemic, we’ve seen AI capture the No. 1 position in the last two surveys. And we think this dynamic will continue for quite some time as AI becomes a staple of digital transformations and automation. And AI will be infused in every single dot you see on this chart.

The “aha” is that Nvidia’s architectures are tailor-made for AI workloads and virtually every segment in the above graphic will be using Nvidia’s technology.

Let’s quantify what this means and lay out our view of how Nvidia, with the help of Arm, will go after the enterprise market.

In the graphic above we show projections from from Wikibon Research that depict the percent of worldwide spending on server infrastructure by workload type. Here are the key points:

Nvidia, with Arm, in our view is well-positioned to attack the offload market and, logically, the AI-based work. But even portions of the orange general purpose segment can go to Arm-based systems. As we’ve reported, for example, companies such as Amazon Web Services Inc. and Oracle use Arm-based designs to serve general purpose workloads.

Why are they doing that? Cost. Because x86 generally and Intel specifically are not delivering the price/performance and efficiency required to keep up with the demands to reduce data center costs. So these companies are working with independent software vendors to ensure that general purpose apps run on Arm-based processors with no changes required by the customer.

If Intel didn’t respond to this obvious dynamic, we think it would get 50% of the general-purpose workloads by the end of the decade. And with Nvidia, it will dominate the blue AI+ and the gray offload work — dominate as in capture 90% of the available market.

Now Intel isn’t going to sit back and let that happen. Intel CEO Pat Gelsinger is well aware of this and is moving Intel toward a new strategy that can better manage memory resources and accommodate offload processing and greater programmability by the ecosystem. But Nvidia and Arm are way ahead in the game. In addition, Nvidia is increasingly partnering with storage leaders such as NetApp Inc., DataDirect Networks Inc., VAST Data Inc., WekaIO Inc., Pure Storage Inc. and others, which we believe will align with its strategy for portions of their portfolio.

Nvidia made its name as a gaming company. Even today, nearly half of its revenue comes from that segment. Ask any gamers what they think of Nvidia and they’ll go on and on about Nvidia’s incredible performance, its amazing drivers, its smoother coloration, cleaner image presentation, superior resource allocation and other features such as screen recording capabilities. The only thing they don’t absolutely love is the price – nice problem to have.

But Nvidia has expanded its total available market by going after enterprise markets. Let’s take a quick look at what Nvidia is doing with parts of its enterprise portfolio that we feel are relevant to this discussion.

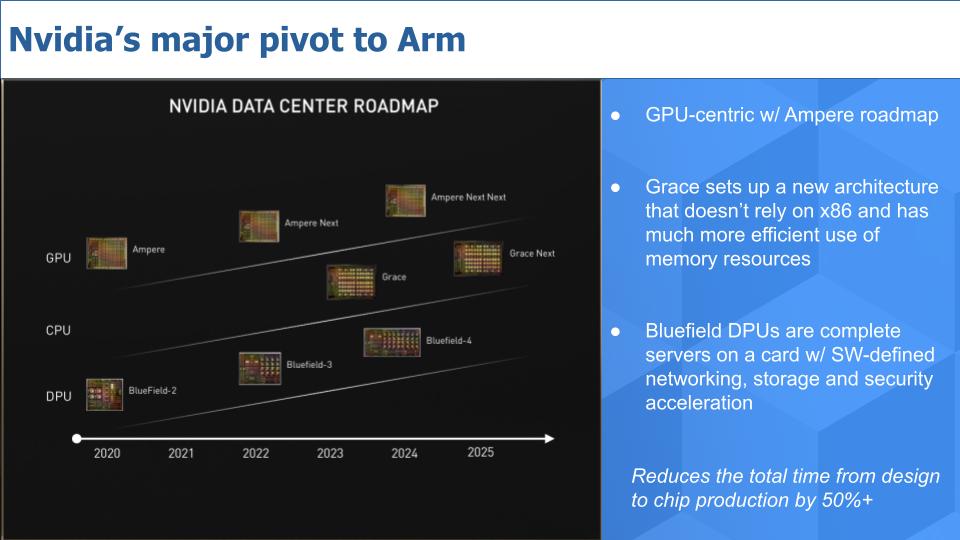

Above is a slide from Nvidia’s investor deck that highlights the company’s three-chip strategy. Importantly, Nvidia is aggressively moving to Arm-based architectures, which we’ll describe in more detail later. The slide shows on the top line Nvidia’s Ampere architecture, not to be confused with the company Ampere Computing. Nvidia is taking a graphics processing unit-centric approach for obvious reasons — that’s its wheelhouse — but we think over time it may rethink this and diversify more into alternatives such as NPUs for cost and flexibility reasons. But we’ll save that for another day.

In the middle line, Nvidia has announced its Grace CPU, in a nod to the famous computer scientist Grace Hopper. Grace is a new architecture that doesn’t rely on x86 and much more efficiently uses memory resources.

And the bottom line shows the roadmap for Nvidia’s Bluefield DPU, which as Zeus Kerravala described is essentially a complete server on a card.

The last point on the above chart is super-important and often overlooked. Moving to Arm will reduce the elapsed time to go from chip design to production by 50%. We’re talking shaving years down to 18 months or less. This will give Nvidia a significant time-to-market advantage in the enterprise.

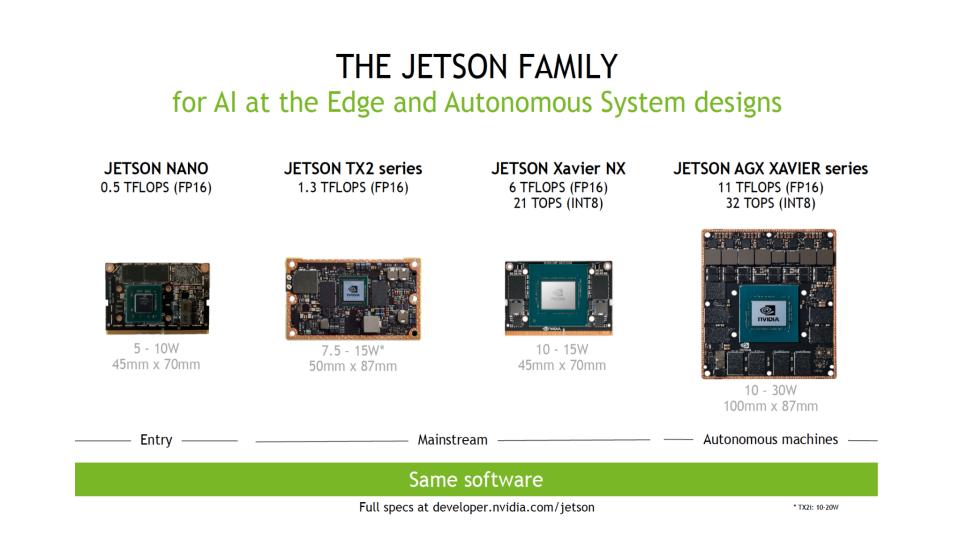

We’re not going to do a deep dive into Nvidia’s enterprise product portfolio. There’s plenty of information on the web if you’re interested. However, we believe the graphic below highlights some things we think are important as it relates to Nvidia’s end-to-end strategy.

The graphic above shows selected details of Nvidia’s Jetson architecture, which is designed to accelerate those AI+ workloads that we showed earlier in the blue bar chart. The reason this is important in our view is that the same software supports small to very large, including edge, systems. We think this type of architecture is well-suited for AI inference at the edge as well as core data center applications that use AI. So this is a good example of leveraging an architecture across a wide spectrum of performance and cost that we think will serve Nvidia well.

Specifically as it relates to edge workloads, we believe today’s traditional server vendors are missing the larger opportunity – mainly because it’s currently small and they can’t justify the investment. These players are rightly staying close to their customers and networking with industrial giants to identify ways they can reorient their existing x86 architectural investments toward what they see as “the edge.”

We believe they largely view their edge opportunity as a mini-data center or aggregation point for data. They want to provide horizontal infrastructure at scale to take advantage of their operating leverage. And they’re prudently circumspect about not going to the “far edge” and get too deep into specialized applications.

We believe Nvidia and Arm see the bigger picture. When vendors throw out TAM figures that the edge will be trillions of dollars in value, we believe the real opportunity is with real-time AI inferencing deep within the instrumented edge. This will require lots and lots of processing and it won’t look like anything like traditional x86 servers. These servers will be space-efficient, low-power, tightly packaged or embedded, high-performance, programmable and super-cheap. And that’s where we believe Nvidia and Arm are headed.

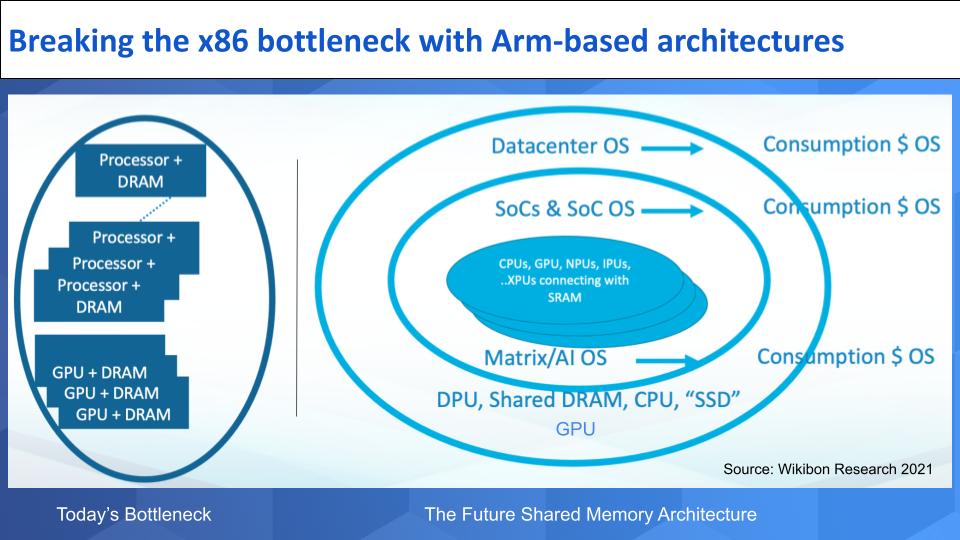

We want to take a moment to explain why we think the move to Arm-based architectures is so important to Nvidia.

One of the biggest cost challenges for Nvidia today is keeping the GPU utilized. Typical utilization of GPUs is well below 20%. The graphic above is an attempt to explain why.

Imagine that the lefthand side of the chart shows racks of traditional compute. It underscores the bottlenecks Nvidia faces. The processor and DRAM are tied together in separate blocks. Imagine there are thousands of cores in a rack. Every time the system needs data that lives in another processor it has to send a request and go retrieve it, which is overhead-intensive. Technologies such as RoCE are designed to help, but that doesn’t solve the fundamental architectural bottleneck.

Because every GPU, as shown on the left at the bottom, also has its own DRAM, it has to communicate with the processors to get to the desired data – that is, they can’t communicate with each other efficiently.

The righthand side shows where Nvidia is headed. Start in the middle with systems-on-chip or SoCs. CPUs are packed with NPUs, IPUs (image processing units) and XPUs (other alternative processors). These are all connected with SRAM, which is a high-speed layer, such as an L1 cache. The operating system for the SoC lives inside and this is where Nvidia has a killer new pricing model.

The company is licensing the consumption of the OS that’s running the system and effecting a new and really compelling software subscription model that aligns with the way enterprise buyers are increasingly buying software. In theory Nvidia could give away the chips for free and just charge for the software, like the razor blade model.

The outer layer on the righthand side is the DPU and shared DRAM and other resources (such as Ampere Computing – the company this time – along with CPUs, solid-state devices and other resources). These are the processors that will manage the SoCs together.

This design is based on Nvidia’s three-chip approach using the Bluefield DPU, leveraging Mellanox (that’s the network). The network enables shared DRAM across the CPUs, which will eventually be all Arm-based. Grace lives inside the SoC and also on the outside layers. And of course the GPU lives inside the SoC in a scaled-down version (for example, a rendering GPU) and we show some GPUs on the outer layer as well for AI workloads – at least in the near term. Eventually we think they may reside solely in the SoC, but only time will tell.

So as you can see, Nvidia is making some serious moves by teaming up with Arm and leaning into the Arm ecosystem. This is how it plans to improve the efficiency of its solutions dramatically, reduce its reliance on x86 and support those emerging AI-based workloads we described earlier.

Below is that same XY chart showing Market Share or pervasiveness tracking against Net Score or spending momentum. And we’ve cut the ETR data to capture compute, storage and networking segments for some of the leading players that we feel are vying for compute data center leadership.

AWS is in a very strong position. We believe more than half of its revenue comes from compute, so we’re talking about more than $25 billion on a run-rate basis. Huge. The company designs its own silicon and is working with ISVs to run general-purpose workloads on Arm-based Graviton chips. Microsoft and Google LLC are big consumers of compute and they sell a lot. Microsoft in particular is likely to continue to work with original equipment manufacturing partners to attack the on-prem data center opportunity, but it’s really Intel that is the provider of compute to the likes of Hewlett Packard Enterprise Co., Dell Technologies Inc., Cisco Systems Inc. and the original design manufacturers that are not shown here.

HPE has historically developed architectures. We hate to bring it up, but remember “The Machine?” We realize it’s the butt of many jokes from competitors and HP deserves some heat for all the fanfare and then quietly putting The Machine out to pasture. But HPE has a strong position in high-performance computing, which is AI- and data-intensive. And the work it did on new computing architectures and shared memories from its lab experiment might still be kicking around and could come in handy some day in this future we’re describing here. HPE has also been known to design its own custom silicon, so we would not count them out as an innovator in this race.

Cisco is interesting because it not only has custom silicon designs but its entry into the compute business with its Unified Computing System a decade ago was notable in that it created a new way to think about integrating data center resources. Cisco invests in architectures and we expect the next generation of UCS will mark another notable milestone in the company’s data center business. As well, the company has serious security chops and has made numerous acquisitions to shore up its position in the data center, such as AppDynamics, ThousandEyes, Banzai, Meraki and others.

Dell just had an amazing quarterly earnings report. The company grew top-line revenue by about 12% and it wasn’t attributable to an easy compare relative to last year. Dell is simply executing, despite continued softness in the legacy EMC storage business. Laptop demand continues to soar and Dell’s server business is growing again. But we don’t see Dell as an architectural innovator in compute. Rather we think the company will be content to partner with suppliers, whether Intel, Nvidia, Arm-based partners or all of the above. We predict Dell will rely on its massive portfolio, excellent supply chain and execution ethos to squeeze out margins by integrating core architectural innovations developed by others. We do expect, however, especially in storage, that the company will tap lower-cost alternatives to better service those offload workloads we discussed earlier.

IBM is notable for historical reasons. With its mainframe, IBM created the first great compute monopoly before unwittingly handing it to Intel along with Microsoft. We don’t see IBM aspiring to retake the compute platform mantle it once held with mainframes. Rather Red Hat and the march to hybrid cloud is the path in our view.

The elephants in the room: Intel, Nvidia and China Inc.

Now let’s get down to the big dogs: Intel, Nvidia and China Inc. China is relevant because of companies such as Alibaba, Huawei Technology Co. Ltd. and the Chinese government’s desire to be self-sufficient in semiconductor technology.

But our premise here is that the trends are favoring Nvidia over Intel in the above picture and hence the relative positioning we chose for the logos. Nvidia is making moves to further position itself for the new workloads in the data center and compete for Intel’s stronghold. Intel will attempt to remake itself, but it should have initiated the moves Pat Gelsinger is making today five to seven years ago. Intel can’t change that and is simply far behind. It will take the company years to catch up.

Let’s stay on the Nvidia-versus-Intel comparison for a moment and take a snapshot of the companies’ financials.

Above is a quick and dirty chart we put together with some straightforward key performance indicators. Some of these figures are approximate or rounded, so don’t stress over it too much. But you can see Intel is about an $80 billion company – four times the size of Nvidia. Yet Nvidia’s market value far exceeds that of Intel. Why? Because of the growth line. And in our view it’s justified thanks to Nvidia’s stronger strategic positioning.

Intel used to be the gross margin king, but Nvidia has much higher margins. When it comes to free cash flow, Intel still is dominant. As it pertains to the balance sheet, Intel, especially with its new foundry strategy, is a way more capital-intensive business than Nvidia. As Intel starts building out more manufacturing capacity for its foundries, it will pressure the company’s cash position.

In the third column we put together a back-of-napkin pro forma for Nvidia + Arm circa end of 2022. We think they could get to a run rate that is about half the size of Intel’s revenue. And that could propel the company’s market cap to well over a half-trillion dollars if they get any credit for Arm. The risk is that because the Arm deal is based on cash plus tons of stock, it could put pressure on the market capitalization for some time.

Arm has 90% gross margins because it pretty much has a pure license model, so it helps gross margin a bit– but Arm is relatively small at around $2 billion in revenue, so it doesn’t move the needle that much. The balance sheet data is a swag. Arm has said it’s not going to take on debt to do the transaction, but we haven’t had time to figure out how it can do that without taking on some debt, so we took a guess as to how we’d approach it with today’s ultra-low cost of capital.

The point is that, given the momentum and growth of Nvidia, its strategic position in AI, its deep engineering aimed at all the right places and its potential to unlock huge value with Arm, on paper it looks like the horse to beat if it can execute.

The architectures on which Nvidia is building its dominant AI business are evolving. The workload mix and future demand is heading right at these new architectures, in our view. Nvidia is well-positioned to drive a truck right through the enterprise, in our opinion.

The power has shifted from Intel/x86 to the Arm ecosystem and Nvidia is leaning in, whereas Intel has to preserve its current business while recreating itself. That will take time. But Intel potentially has the powerful backing of the U.S. government.

The wild card is: Will Nvidia be successful in acquiring Arm? Certain factions in the U.K. and the EU are fighting the deal because they don’t want the U.S. dictating to whom Arm can sell technology – such as the restrictions placed on Huawei for many suppliers of Arm-based chips. In addition, Nvidia’s competitors such as Broadcom Inc. and Qualcomm Inc. are nervous that if Nvidia gets Arm, they’ll be at a competitive disadvantage. And for sure China doesn’t want Nvidia controlling Arm for obvious reasons and it will do what it can to block the deal or put handcuffs on how business can be done in China.

We can see a scenario where the U.S. government pressures U.K./EU regulators to let the deal go through in exchange for commitments to help fund plants in Europe. AI and semiconductors: You can’t get more strategic than that and we think the U.S. military has every reason to support this deal. In exchange for facilitating the deal, the government pressures Nvidia to feed Intel’s foundry business, along with our previous scenario with Apple. At the same time, governments could impose conditions that secure access to Arm-based technology for Nvidia’s competitors.

We don’t have any inside information as to what’s happening behind the scenes, but on its earnings call, Nvidia said it’s working with regulators and is on track to complete the deal in early 2022.

Lots is at stake and there are multiple constituents to serve in this chess game. Strategic national considerations are clashing with calls to break up or limit big tech. Meanwhile, China acts with clarity and certainty. The door is open for Nvidia to grab a big prize in data center markets and, even without owning Arm, we think the company is better-positioned than any other firm to serve the future needs of enterprise tech.

Give us your thoughts, data or insights on this and other topics we cover. Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU