CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Virtually all tech companies have expressed caution on their respective earnings calls. And why not? The macroeconomic environment is full of uncertainties and there’s no upside to providing aggressive guidance when sellers punish even the slightest miss.

Moreover, the spending data confirms the market is softening across the board, so it’s becoming expected that chief financial officers will guide cautiously. But companies facing execution challenges can’t hide behind the macro. Which is why it’s important to understand which firms are best positioned to maintain momentum through the headwinds and come out the other side stronger.

In this Breaking Analysis, we’ll do three things: 1) Share a high-level view of the spending squeeze almost all sectors are experiencing; 2) Highlight some of those companies that continue to show notably strong momentum – and relative high spending velocity on their platforms – albeit less robust than last year; and 3) give you a peek at how one senior technology leader in the financial sector sees the competitive dynamics among Amazon Web Services Inc., Snowflake Inc. and Databricks Inc.

Friday morning’s Barron’s Daily told us how bad things are and why they could get worse. The S&P Thursday hit a new closing low for the year. Bonds, normally the safe haven, are sucking wind. The market hasn’t seemed to find a floor. Central banks are raising rates, inflation is still high but the job market remains strong. Not to mention that U.S. debt service is headed toward $1 trillion per year and the geopolitical situation is pretty tense. And Europe is a mess.

So the Santa Claus rally is looking pretty precarious. Especially if there’s a liquidity crunch coming.

Last week we showed you this graphic ahead of the UiPath event.

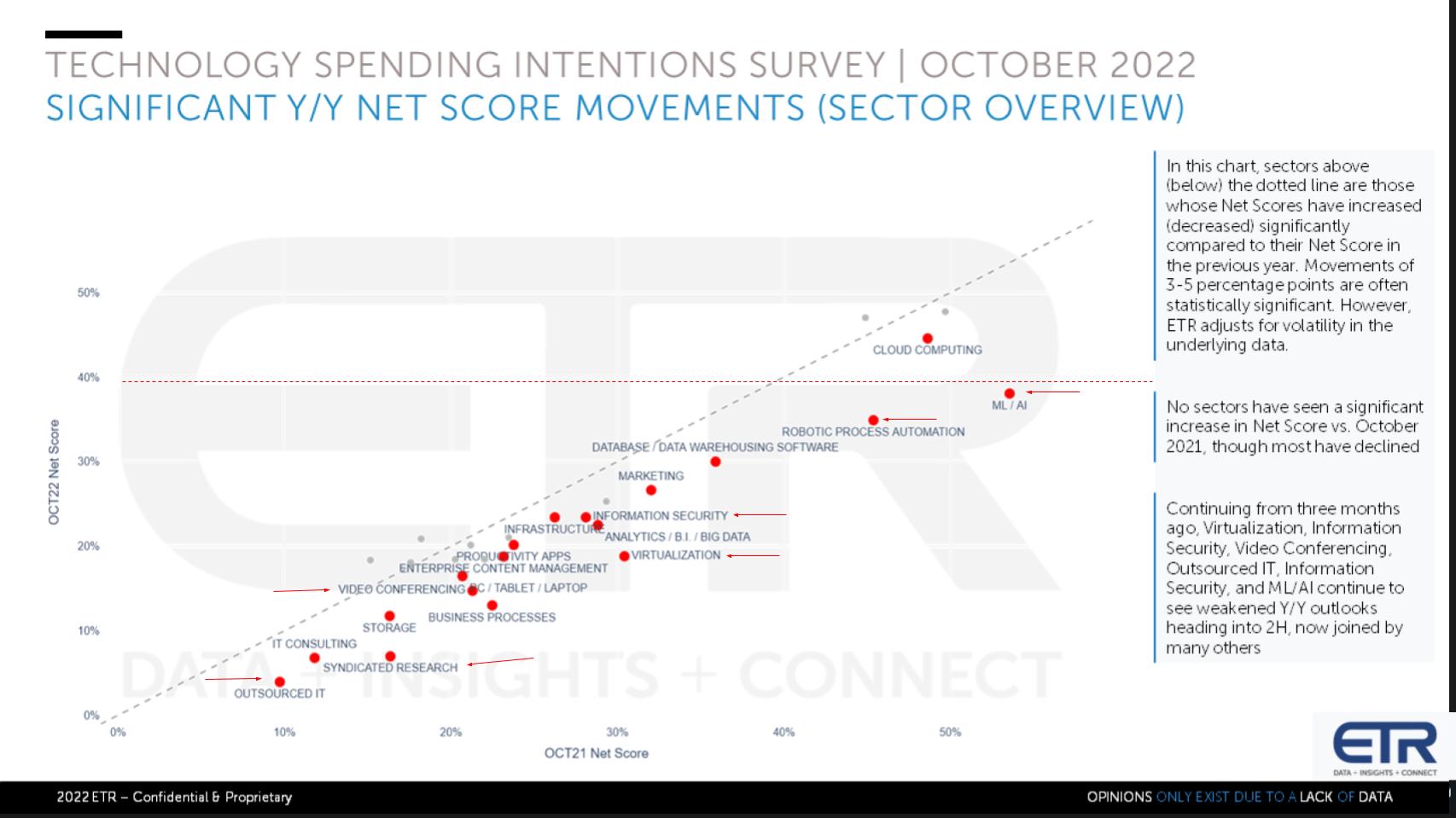

For months, the Big Four sectors, cloud, containers, artificial intelligence and robotic process automation have shown spending momentum above the rest. The chart above shows Net Score or spending velocity on specific sectors. These four have consistently performed each quarter above the 40% mark – for at least 10 quarters in a row. Until this latest ETR survey. ML/AI and RPA have decelerated, as shown by the squiggly lines, and our premise was they are more discretionary than other sectors.

The Big Four is now the Big Two – cloud and containers.

But the reality is almost every sector in the ETR taxonomy is down, as shown above. The chart displays in red dots the sectors that have decreased in a meaningful way. Almost all sectors are now below the trend line and only cloud and containers (as we showed earlier) are above the magic 40% mark. (Container platforms and container orchestration are the gray dots.) And no sector has shown a significant increase in spending velocity relative to October 2021.

In addition to ML/AI and RPA, information security, virtualization, videoconferencing, outsourced IT and syndicated research stand out as ones that have declined at a higher rate in the survey. One could make the assumption that these are more discretionary. The outlier is security. We would argue that security is less discretionary but you’re seeing a share shift as we’ve previously reported – toward modern platforms and away from point tools where legacy spending is being consolidated at a rapid rate.

The point is there’s no sector that is immune from the macro environment. Remember, as we reported last week, we’re still expecting 4% to 6% information technology spending growth this year relative to 2022.

It’s a dynamic environment and of course that could change in either direction.

Below we take a look at some of the key names to investigate how they’re doing on a relative basis.

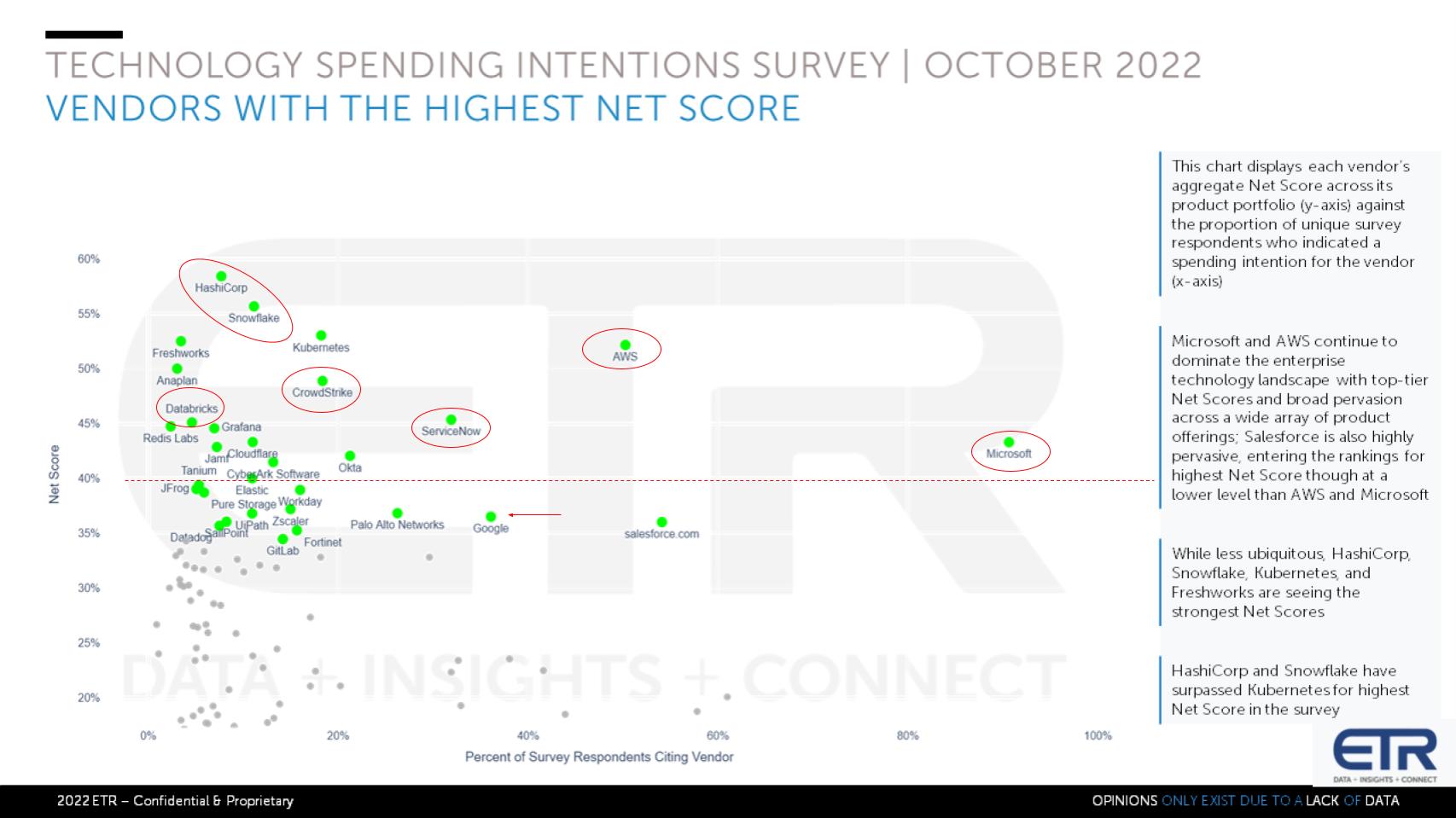

This chart above shows the Net Score or spending momentum on the Y axis and the pervasiveness of the vendor within the ETR survey – measured as the percentage of respondents (N>1,000) citing the vendor is in use.

As usual, Microsoft Corp. and AWS standout because they are both pervasive and elevated. For two companies of this size to demonstrate and maintain Net Scores above the 40% mark is impressive. AWS is showing a noticeably higher Net Score on the vertical scale, which we reported in our video is a new trend, as normally we see Microsoft dominating on both dimensions. Upon further investigation, however, we realized that this is not a break from the trend. Rather we normally compare AWS with Azure, where Azure in the survey has consistently shown higher spending velocity than AWS and that remains the case today.

Salesforce Inc. is impressive owing to its overall size and financial execution but below Microsoft and AWS on the vertical axis.

Google is meaningfully large, but relative to the other big public clouds, we see its position as somewhat disappointing. Sarbjeet Johal posted on Twitter that John Blackledge of Cowen went on CNBC this week and said that GCP by his estimates are 75% of Google Cloud’s revenue and is now only five years behind AWS and Azure.

Our models differ. Google Cloud Platform by our estimates is running at about $3 billion per quarter, or more like 60% of Google’s reported overall cloud revenue. You have to go back to 2016 to find AWS running at that level. And 2018 for Azure. So we’d estimate that GCP is six years behind AWS and four years behind Azure from a revenue performance standpoint. Now, techwise you can make a stronger case for Google, but revenue is a strong metric in our view and four to six years is a long time in cloud.

We circle ServiceNow Inc. above because the company has become or is on its way to being generational. And impressively, it remains above the 40% line. We were at CrowdStrike Holdings Inc.’s conference with theCUBE two weeks ago and saw firsthand what we see as another generational company in the making. And you can see above that CrowStrike’s spending momentum is impressive.

Hashicorp and Snowflake have now surpassed Kubernetes to claim the top Net Score metric. (We know Kubernetes isn’t a company, but ETR tracks it as though it were just for context.) And we’ve highlighted Databricks as well…showing momentum, but it doesn’t have the market presence of Snowflake.

And there are a number of other players in the green: Pure Storage Inc., Workday Inc., Elastic NV, JFrog Inc., Datadog Inc. And in security, Palo Alto Networks Inc., Zscaler Inc., CyberArk Software Ltd., SailPoint Technologies Holdings Inc., Tanium Inc. and Fortinet Inc..

But again, these names are virtually all off their recent highs of 2021 and early 2022.

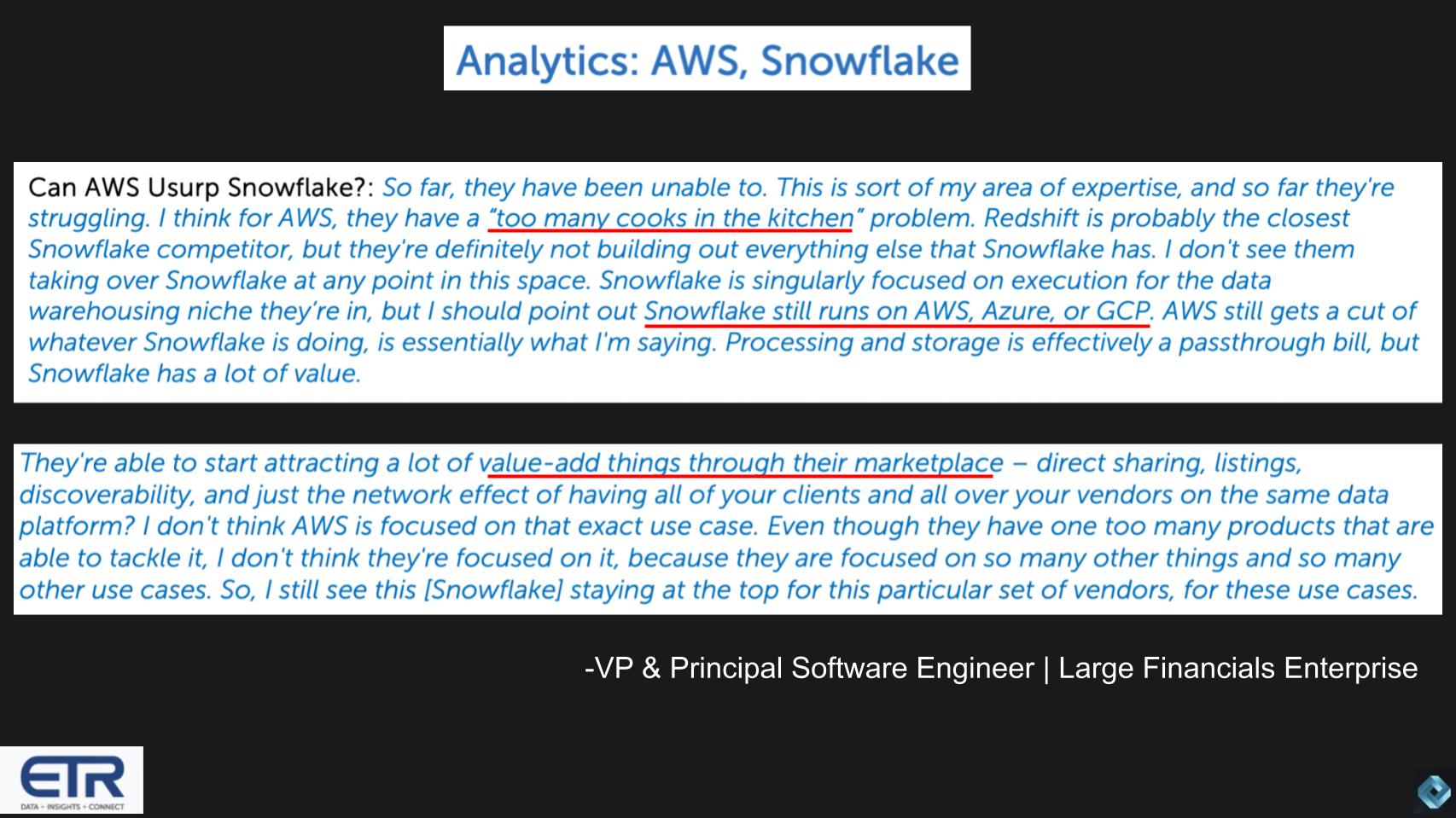

Our colleague Erik Bradley recently held an in-depth interview with a senior executive at a large financial institution to dig into the analytics space. And there were some interesting takeaways that we’d like to share. The first shown below is a discussion about whether or not AWS can usurp Snowflake as the top dog in analytics.

This individual’s take was interesting. Note the comment, “This is my area of expertise.” We can attest that this practitioner has deep experience with numerous data platforms. And while it’s only an N of 1, the commentary is useful and we believe reflects an accurate picture of the overall market.

This person cited AWS’ numerous databases as problematic, but Redshift was cited as the closest competitor to Snowflake. This individual also called out Snowflake’s current cross-cloud advantage (supercloud) as well as the value-add in its marketplace as a differentiator.

But the real point this person was actually making is that cloud vendors make a lot of money from Snowflake. AWS, for example, sees Snowflake as much more partner than competitor and as we’ve reported. Snowflake drives a lot of compute and storage revenue for AWS. In fact, we believe Snowflake has rapidly become one of AWS’ largest, fastest-growing and most important customers and partners.

Now, as well, this doesn’t mean AWS doesn’t have a strong marketplace – it does, the best in the business. But the point is Snowflake’s is exclusively focused on a data marketplace and the company’s challenge and opportunity is to build that up, continue to add partners and create network effects that create a long-term sustainable moat for the company. — while at the same time staying ahead of the competition.

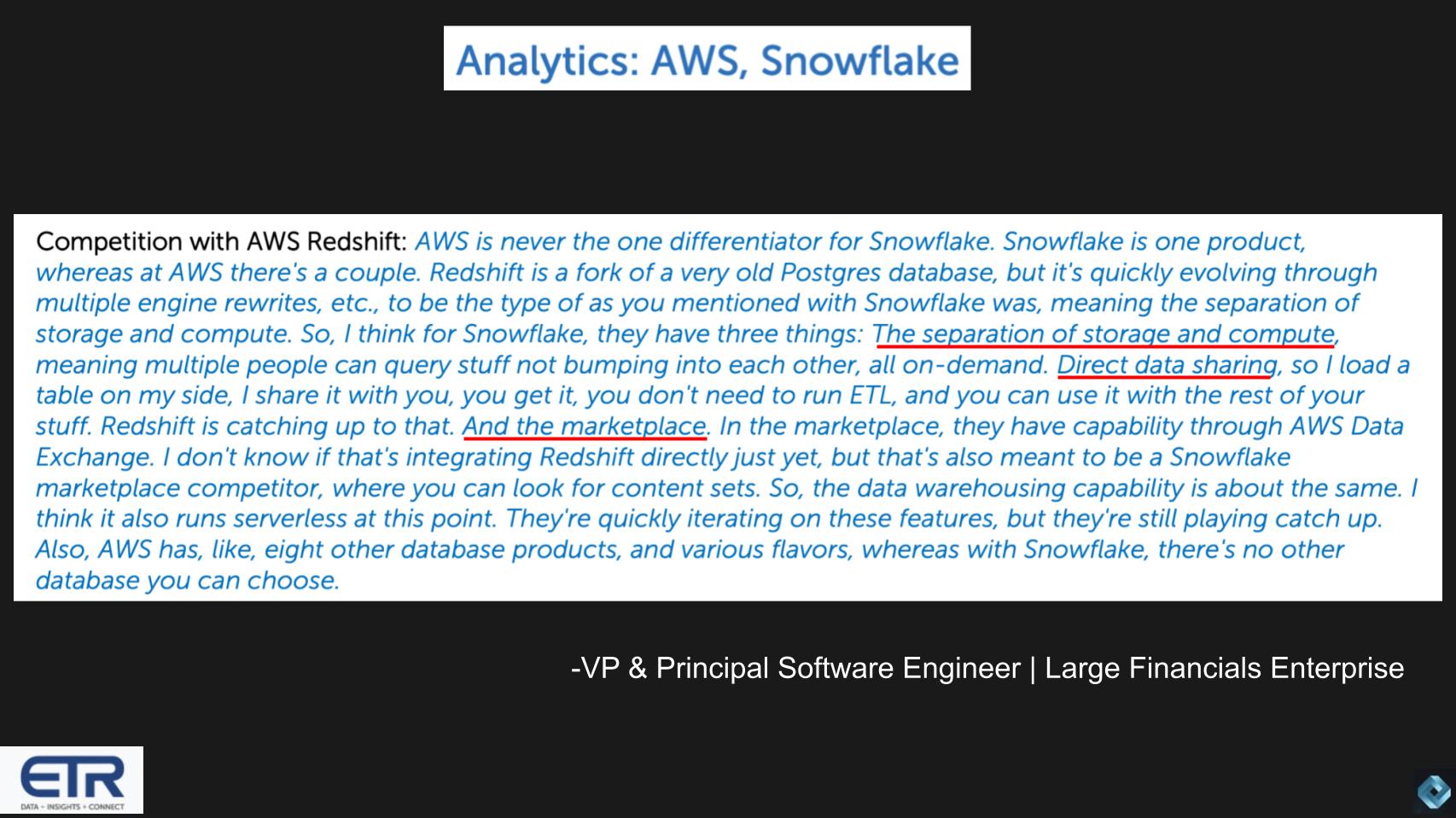

The other commentary that caught our attention was a discussion about Snowflake’s unique capabilities.

This individual cited three areas: 1) The separation of compute and storage – which AWS has replicated, sort of – not as elegant in the sense that you can reduce the compute load with Redshift, but unlike with Snowflake you can’t shut it down; 2) Snowflake’s data sharing capability and 3) Snowflake’s marketplace… again a key opportunity for Snowflake to build out its ecosystem, close feature gaps and importantly, create governed and secure data sharing experiences for anyone on its Data Cloud.

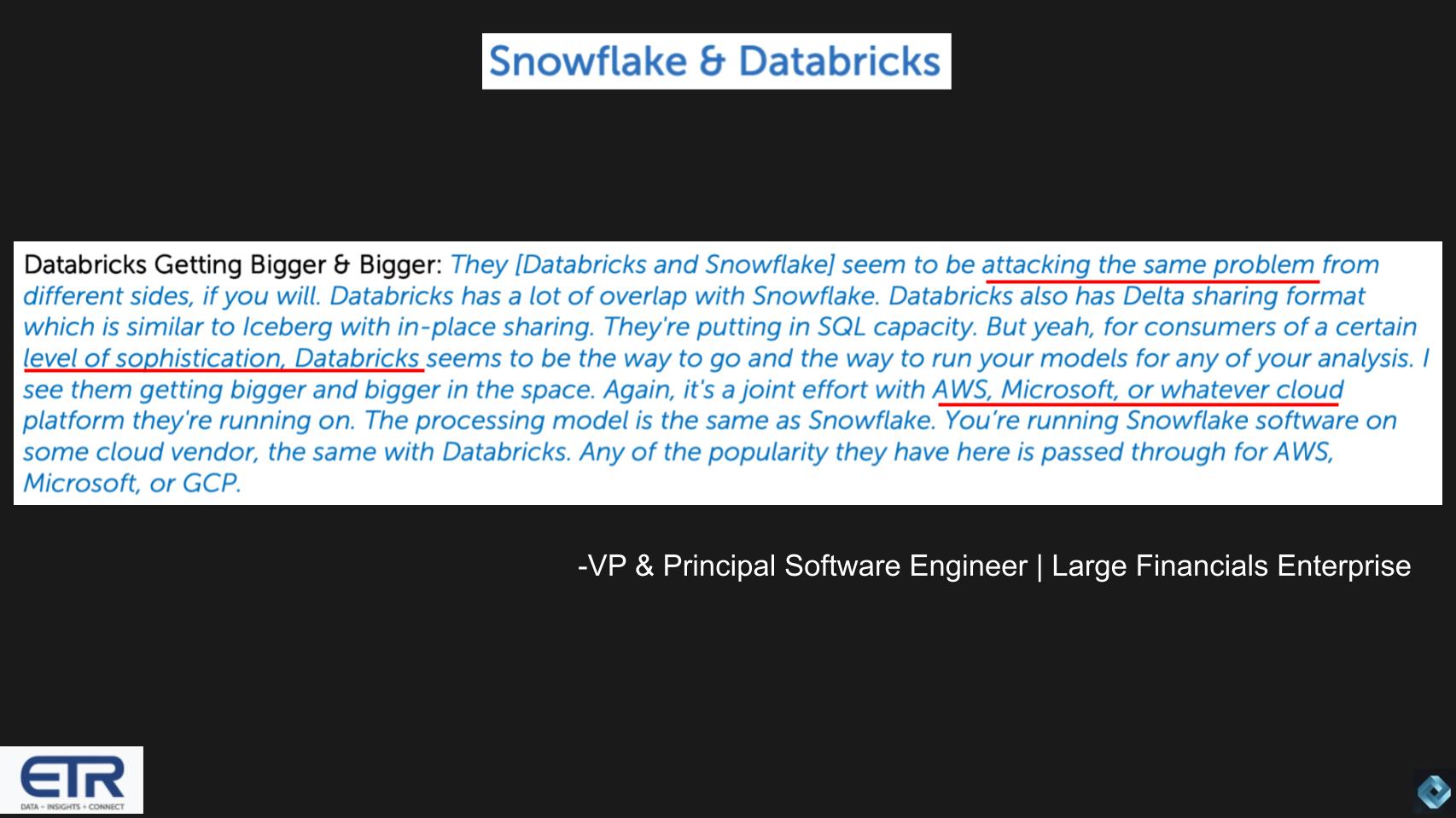

Now the last thing this individual addressed is how Databricks and Snowflake are attacking a similar problem – i.e. simplifying data, data sharing and getting more value from data – but skinning the cat, so to speak, in different ways.

The key messages here are there’s overlap with these two platforms but Databricks appeals to a more techie crowd – you open a notebook when you’re working with Databricks and more likely to be part of a data science team. With Snowflake you’re likely to be coming at the problem from a traditional data analytics perspective and more aligned with the line of business, often with an industry emphasis.

Note the similarities in terms of cross-cloud or supercloud designs.

Like many others, we’ve often discussed Snowflake versus Databricks – how can you not as an independent observer? It’s an interesting topic with a bit of drama thanks to vendor marketing, benchmarketing and counter-punching. Snowflake is moving into the data science arena from its data warehouse strength and Databricks is moving into analytics and the world of SQL from its AI/ML position of strength. Both companies are doing well – although Snowflake was able to get to the public markets and Databricks has not.

[Note: Because of red-eyes and hurricanes, the analyst takes didn’t make it into this week’s video.]

Sanjeev Mohan

We’ve had many conversations with former Gartner lead data analyst and friend of theCUBE, Sanjeev Mohan on this topic. We would summarize his thoughts on the appeal of Databricks and Snowflake as follows:

Databricks appeals to users that are not only data engineers, but also heads of data teams who are living with the dysfunctional nature of data, understand the pain and want to lean into solving complex technical problems. Snowflake, on the other hand, has more fine-tuned messaging, emphasizing value and monetization. Snowflake appeals to organizations that want simplicity and don’t want to be tech shops per se.

George Gilbert

We asked former Wikibon and Gartner analyst George Gilbert to weigh in on the broader topic of Databricks versus Snowflake and the core sweet spots in addressing the spectrum of workloads in today’s market. Here’s what he shared:

There are two ways of looking at this. One is how they compete for today’s workloads where each is trying to encroach on the other’s territory. Snowflake has clear advantages here. But the other, more significant opportunity is building data applications that track and orchestrate what’s happening in the real world, which some call data apps. The advantage in this second opportunity is less clear.

Snowflake is undoubtedly stronger in managing data and will only get stronger here. Databricks is stronger in processing data from its raw state into higher value products and has the potential to get stronger if they transition to enabling data applications.

By the way, if you know George Gilbert, he provided us with thousands of more words to go deep into the technical architectures of each platform, which we need time to fully understand and curate before we can share in detail. But here’s a relevant snippet:

Databricks has a big advantage in processing distributed data for a couple reasons. It can invoke multiple processing engines without involving the full overhead of the DBMS engine, as with Snowflake. Snowflake can’t do this because its query engine and storage engine are fused. That’s not a small detail. Witness the extra large instance sizes that are still in development and required just to run Python in Snowpark. This is the whole idea for Databricks separating the storage engine (delta tables) from the processing engines– any notebook (Jupyter, Hex), any AI framework (Tensorflow, Pytorch), any SQL engine (Delta SQL, Trino, Dremio), and MLOps tool chains that include feature stores. I could go on.…

David Floyer

Finally, we asked retired Wikibon analyst David Floyer for his thoughts on the subject. Here’s what he submitted:

Data in data warehouses created without real-time transactional analytics will always be inaccurate. Data warehousing has always suffered from this problem. Snowflake is a better, cheaper and more functional way of creating a data warehouse, but it can never reflect a single version of the truth without combining real-time analytics and transactional processing. In my opinion, Snowflake data warehouses will disappoint just as every other data warehouse preceding it if it can’t solve this problem.Both Databricks and Snowflake are focusing on combining real-time analytics and transactional processing. In my opinion, real-time analytics will bring about much higher levels of data integrity. As a result, higher levels of business process automation can be achieved. This benefit goes straight to the bottom line as a reduction in cost and cycle time. I think there is enormous business value in real-time transactional analytics. A single version of the truth allows real-time, automated decision-making.

Snowflake might make transactional analytics a reality, but we may not know for a decade. Databricks, with improved data processing, may have a better chance of getting there sooner.

We’ll close this section of the post by pointing out that even though Snowflake is on the quarterly shot clock, as we saw earlier it has a larger presence in the market and that is at least partly due to the tailwind of an IPO… and a stronger go-to-market posture. Snowflake must build its ecosystem to close the feature gaps in its platform and build network effects. Being a public company broadens the appeal for ecosystem partners because there’s more awareness in the marketplace, more transparency and greater momentum on the way up.

As the analysts above described, Databricks is coming at the problem from a different angle, heavily leveraging open source versus Snowflake’s approach of accommodating open source tooling downstream in its development cycle. There are advantages and disadvantages to both approaches.

We realize this side discussion was a bit of a tangent, but we had fresh data and wanted to put it out there. Moreover, Snowflake has become a bellwether for a successful pandemic boom initial public offering, whereas Databricks is a private company, destined for IPO but couldn’t squeeze into the window of the isolation economy tech bubble.

Let’s close with some final thoughts.

Things in the short term are really hard to predict. We’ve seen these oversold rallies peter out for the last couple of months because the world is such a mess right now and really difficult to reconcile. Nothing seems to be working from a public policy perspective.

We know tech spending is softening but let’s not forget – at 4% to 6% growth, it’s at or above historical norms. But there’s no question the trend line is down.

That said, there are certain growth companies, several mentioned in this episode, that are modern and vying to be generational platforms. They’re well positioned, financially sound, disciplined with strong cash positions with inherent profitability.

Unfortunately, being a growth company today is not what it was a year ago because of rising rates – the discounted cash flows are just less attractive. So earnings estimates, along with revenue multiples on these growth companies are reverting toward the mean. But companies such as Snowflake, CrowdStrike and others are able to still command a relative premium because of their execution and continued momentum.

Others, as we reported last week like UiPath, despite strong momentum have had execution challenges – Okta Inc. is another that is struggling to execute, in part from challenges integrating Auth0. As a result, despite the growth, these names are getting further punished beyond the benchmark mean from a valuation standpoint.

The bottom line is sellers are still firmly in control. The bulls have been humbled and the traders aren’t buying growth tech – or much tech at all. But long-term investors are looking for entry points because these generational companies are going to be worth significantly more five to 10 years down the line.

Thanks to Erik Bradley, Sanjeev Mohan, George Gilbert and David Floyer for their contributions to this Breaking Analysis. Alex Myerson and Ken Shiffman are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU