AI

AI

AI

AI

AI

AI

When you think of artificial intelligence leadership, which companies come to mind?

Nvidia Corp., OpenAI, the hyperscalers, Meta Platforms Inc., Hugging Face Inc., Anthropic PBC and names like that, right? You don’t typically think of Broadcom Inc., do you?

You should. In our view, Broadcom, along with Nvidia, has become one of the top two AI plays in the public market, despite the fact that it doesn’t make graphics processing units or large language model software. Rather, the company has made a big bet that the central processing unit, along with alternative processors such as the GPU, the neural processing unit, the language processing unit and the like – let’s call them XPUs – will need high-speed, low-cost connections between them based on open technologies that scale and can deliver low-power solutions over a roadmap that will last a decade or more.

Broadcom is perhaps a unique company in the technology business. It doesn’t simply chase markets that are on steep growth curves and can deliver short term return on investment. Rather, it goes after established markets with durable franchises. Broadcom focuses its research and development on serving customers in these markets with major engineering investments to achieve a dominant position in each of its target sectors. And sometimes, the company lucks out with this strategy and catches a wave accidentally by design.

In this Breaking Analysis, we extract key nuggets from our sit down at MWC this week with Charlie Kawwas, president of Broadcom’s Semiconductor Solutions Group, and we unpack the contrarian business technology model of Broadcom.

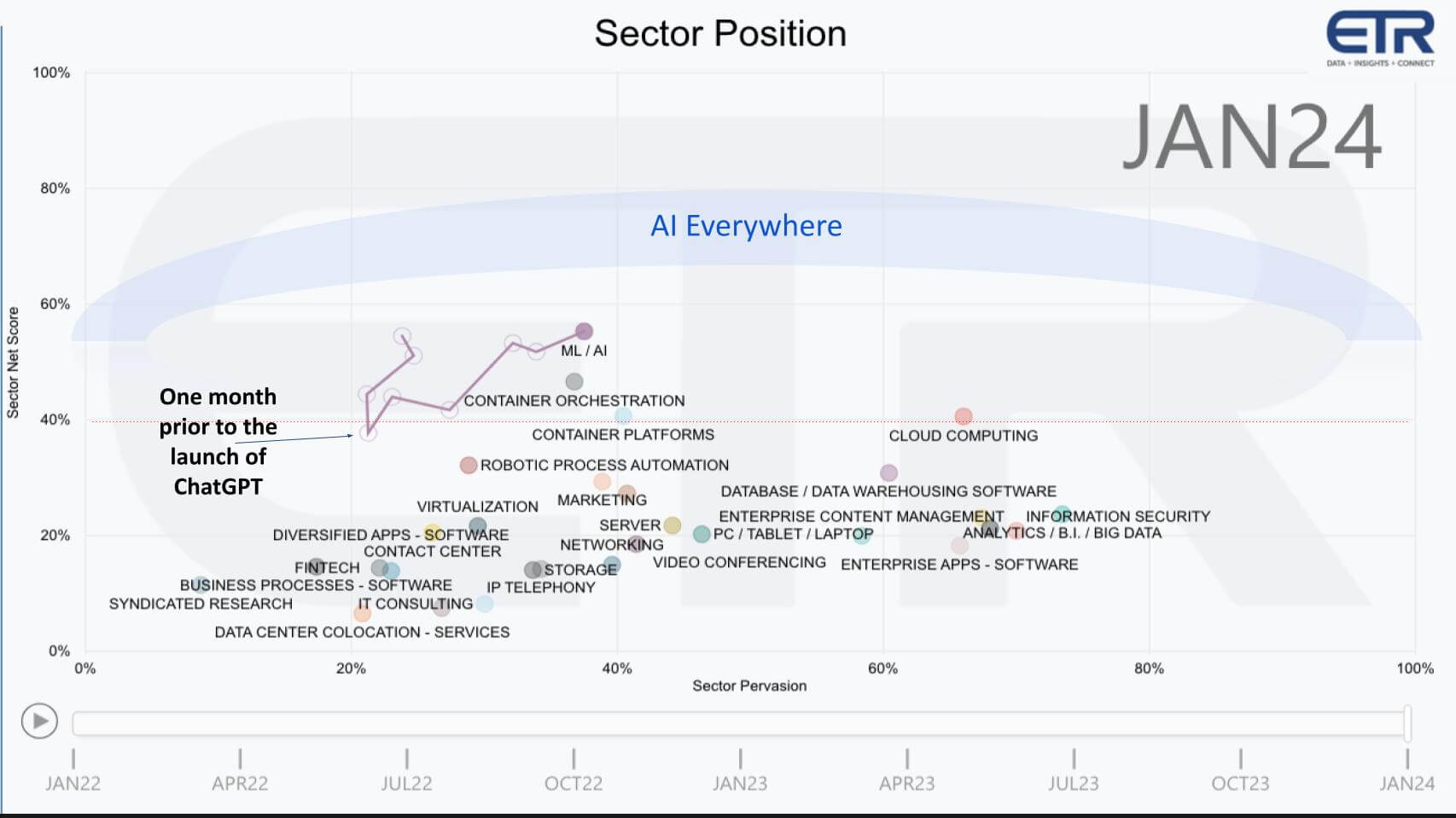

Let’s review the impact AI is having on enterprise tech spending. We showed this Enterprise Technology Research survey data last month, but it’s worth reviewing again.

This is data from more than 1,700 information technology decision makers or ITDMs, which shows Net Score or spending momentum on the vertical axis. The horizontal plane shows Sector Pervasion or penetration into those 1,700 accounts. The red dotted line at 40% indicates highly elevated spending momentum. The data shows how prior to ChatGPT’s announcement, the AI sector was decelerating and that flipped almost overnight to where it is now the No. 1 sector in terms of customer spend momentum.

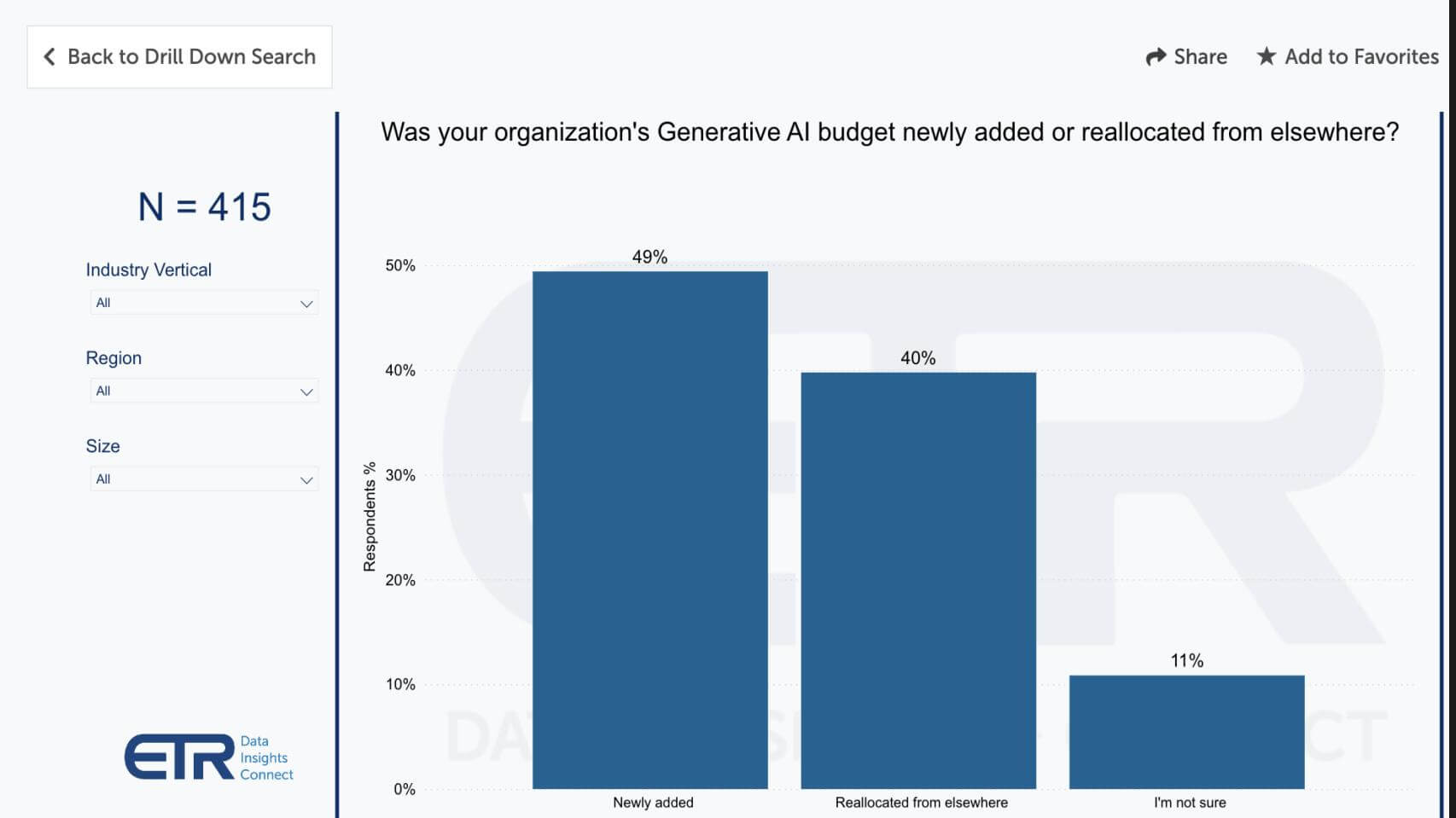

This data from a different ETR survey of 415 ITDMs this quarter shows that 40% customers tell us AI is being funded by taking budget from other areas. As well, we’ve seen evidence that organizations are squirreling away AI budgets as they experiment and figure out what they’re actually going to do in AI. Specifically, ITDMs report caution with how and where they’re spending their AI money.

The point is, if you’re not well-positioned for AI and have to pivot, it can be disruptive and difficult to find talent. It’s no coincidence that last June we saw both Databricks Inc. and Snowflake Inc. acquire AI startups just ahead of their customer conferences. And Snowflake just appointed the chief executive of its AI acquisition as CEO of the company.

Nvidia didn’t have to pivot to generative AI. Its focus on graphics and gaming, it turns out, perfectly position Nvidia to capitalize on the unique nature of AI workloads. It just so happens, so is Broadcom, but for different reasons. Listen to Kawwas explain how “elephant” AI workloads are much different from those that are traditional and general purpose in nature:

This is nuanced, but Broadcom is one of the only companies, other than Nvidia, that makes chips for both internal connectivity for high-performance AI workloads and silicon for high-speed switching across distances. Nvidia’s acquisition of Mellanox Technologies Ltd. gave it a proprietary advantage. Broadcom is countering with an open standards salvo.

History shows that the power of open models almost always win in the long run because millions of engineers can work on a problem versus the staff inside a single company. As Sun Microsystems Inc. co-founder Bill Joy said in 1990:

No matter who you are, most of the smartest people work for someone else.

IBM Corp.’s monopoly power was moderated by the de facto standard of Wintel. Microsoft Corp.’s dominance in operating systems was challenged by the open Linux standard. Open web protocols such as Internet Protocol won the day with the internet buildout and disrupted all the proprietary networks from IBM, Digital Equipment Corp. and other leaders at the time.

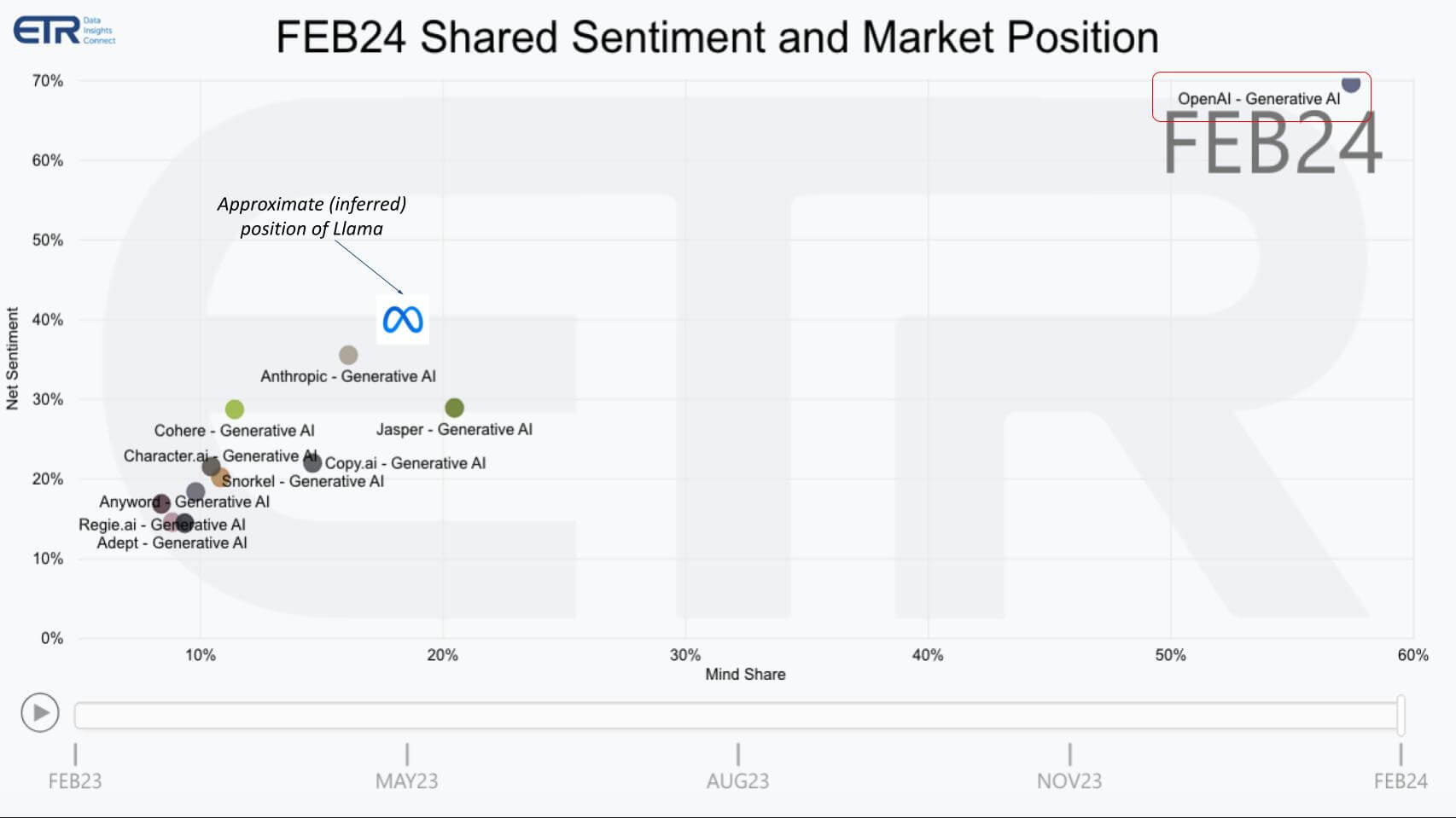

The chart below from ETR is from the emerging technology survey (ETS) that surveys ITDMs about which private company technologies are being deployed. This data is for generative AI.

The chart shows Net Sentiment or intent to engage on the Y axis, with mindshare on the X axis. Notice OpenAI — some call it closed AI — is literally off the charts. Well ahead of the pack, which comprises both proprietary and open source LLMs. We’ve superimposed Meta’s open source Llama, which is not part of the ETS survey but data from other surveys allows us to infer how it is positioned relative to Anthropic and the others. The point is, in the fullness of time, it’s likely that open-source software will win out, despite the substantial lead currently enjoyed by OpenAI.

The relevance to Broadcom is this open philosophy is ingrained in the company’s DNA. A prominent example is the Ultra Ethernet Consortium, an open standard the company is leading, which will challenge Nvidia’s proprietary Infiniband networks. Let’s listen to Kawwas explain his view of open versus proprietary.

In the previous clip you heard Charlie talk about sustainable franchises. Here’s where Broadcom is misunderstood but sharp investors have picked up on this differentiator. Specifically, Broadcom starts by looking at markets. Not hockey-stick markets, rather durable, sustainable businesses with installed bases where a technology and engineering roadmap can be applied for a decade plus.

Let’s listen to Kawwas explain this concept and how it applies to Broadcom’s 26 distinct franchises:

In the previous clip, you heard Kawwas say this applies to software as well as silicon. The company has nine software franchises, including VMware. Many have questioned Broadcom’s software acquisitions. Further, some are critical of Broadcom citing its propensity to aggressively cut headcount of firms it acquires.

Others have likened it to a private equity firm, but this couldn’t be further from the truth. There are similarities in that Broadcom acquires mature businesses that can throw off cash. And it does cut costs to make the franchise more profitable. The difference is it invests in engineering and technology leadership within that franchise.

This is key because essentially by investing in R&D, more than $5 billion annually, even if it raises prices on customers, the business case for those customers to stay is better than migrating because they get ongoing access to an engineering roadmap and don’t have to incur the migration pain.

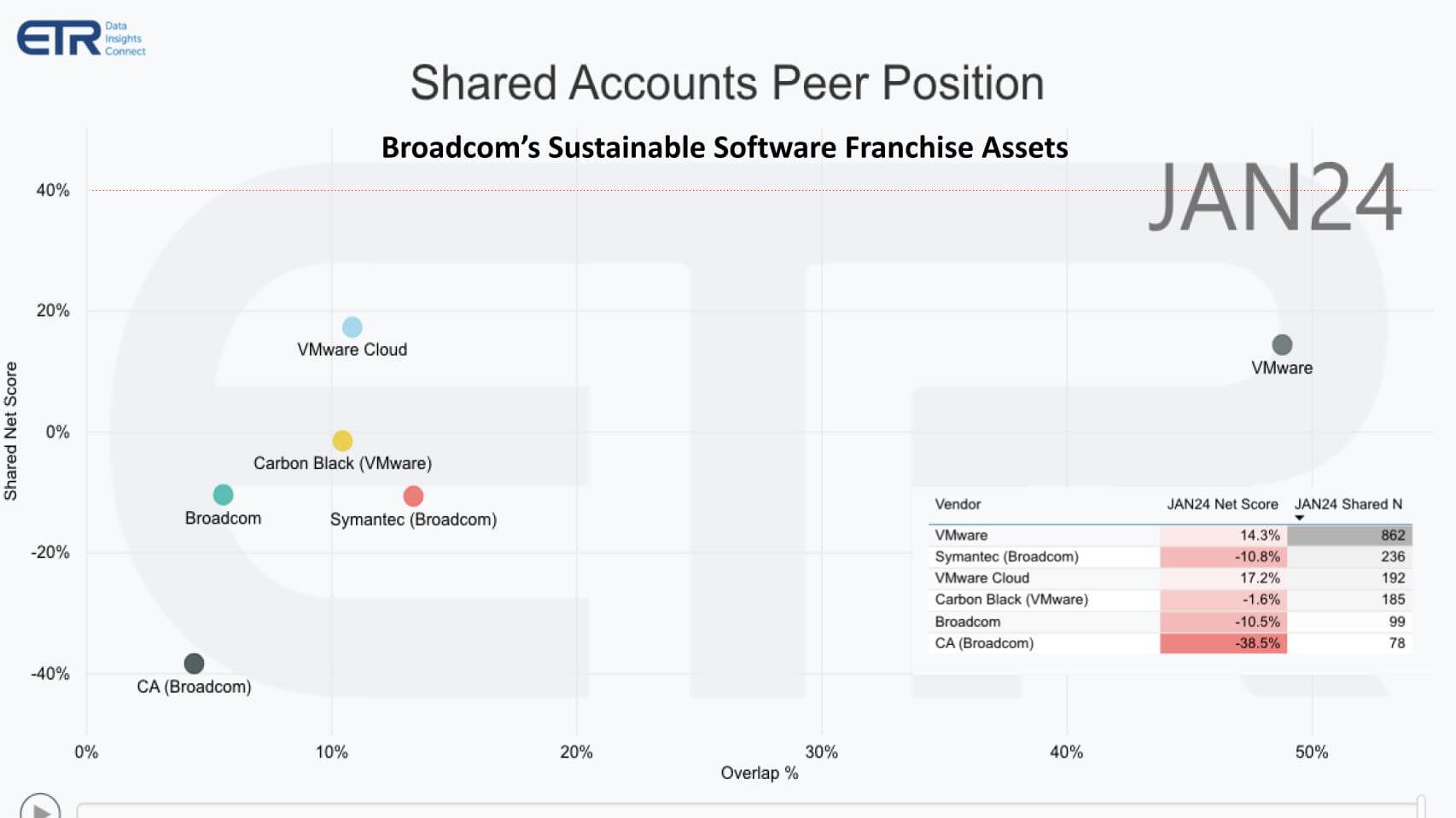

Below we take a look at Broadcom’s software assets from the standpoint of ETR’s survey data.

Above is a similar XY chart with Net Score on the vertical axis. Remember that’s spending momentum. Overlap or penetration into those 1,700 respondent accounts is on the horizontal axis.

Look at the red line on the vertical axis at 40% — that highly elevated spend velocity mark. That would be where the steep growth curves are. Note the table insert showing Net Score and N, which is how the dots are plotted. The Net Scores are all red because they’re so far below the 40% mark. Some are deep in the negative.

Remember this data is percentage of customers, not how much they’re spending. The natural reaction is these are dying markets and not good targets, but Kawwas explained that is a “big mistake” to think that way.

We heard from Kawwas that Broadcom doesn’t chase those short-term hockey sticks, rather it goes after sustainable businesses. Not as in climate — that’s important — but in this context we mean installed bases that can pay back over a decade or more.

So in the table insert, the Ns are what matter most. And look at VMware’s N — 862 out of around 1,700. So VMware is represented in 50% of these accounts. Symantec with 236, VMware cloud, which is mostly VMware Cloud Foundation, adds to the VMware core — as does Carbon Black with 185 N, which we predicted would be de-levered. Rumor has it that Broadcom is no longer selling Carbon Black. Perhaps it couldn’t get its price or maybe Broadcom decided it was a sustainable franchise.

And you see the other software franchises on this chart, including CA.

While we’re not showing it here — when we run the ETR data on infrastructure software, only Microsoft has a bigger installed base than VMware — Broadcom will mine that installed base by narrowing its product focus and targeting R&D to keep those customers coming spending on VMware.

Hopefully this starts to bring into focus Broadcom’s unique strategy a bit more.

Broadcom is positioned in the middle of the AI capital expenditure buildout, as are the hyperscalers, which are a major part of Broadcom’s business. The world, as John Furrier put it, has “just spun in Broadcom’s direction…. People changed their data center to a cloud operating model. Now they’re extending their cloud, hybrid, on-premises and edge deployments, including device mobility.”

It’s a perfect storm where all of these platforms are AI-enabled and involve Broadcom IP. In fact, Broadcom claims that 99% of carrier traffic goes through some type of Broadcom chip. And increasingly that chip will support some type of AI, either training or inferencing. Broadcom plays in both.

The company creates merchant silicon but has evolved its business model to partner for custom silicon, assuming the volume can be sufficient. While Broadcom has 26 business units that stand on their own, it does have a shared engineering resource for foundational technologies. Broadcom applies this capability for both merchant markets and custom opportunities.

Here’s how Kawwas explains the model.

Now that we’ve shared Broadcom’s philosophy and a bit on its business model differentiation, let’s take a look at how the company’s business model translates into financial performance and why it is so well-positioned in AI.

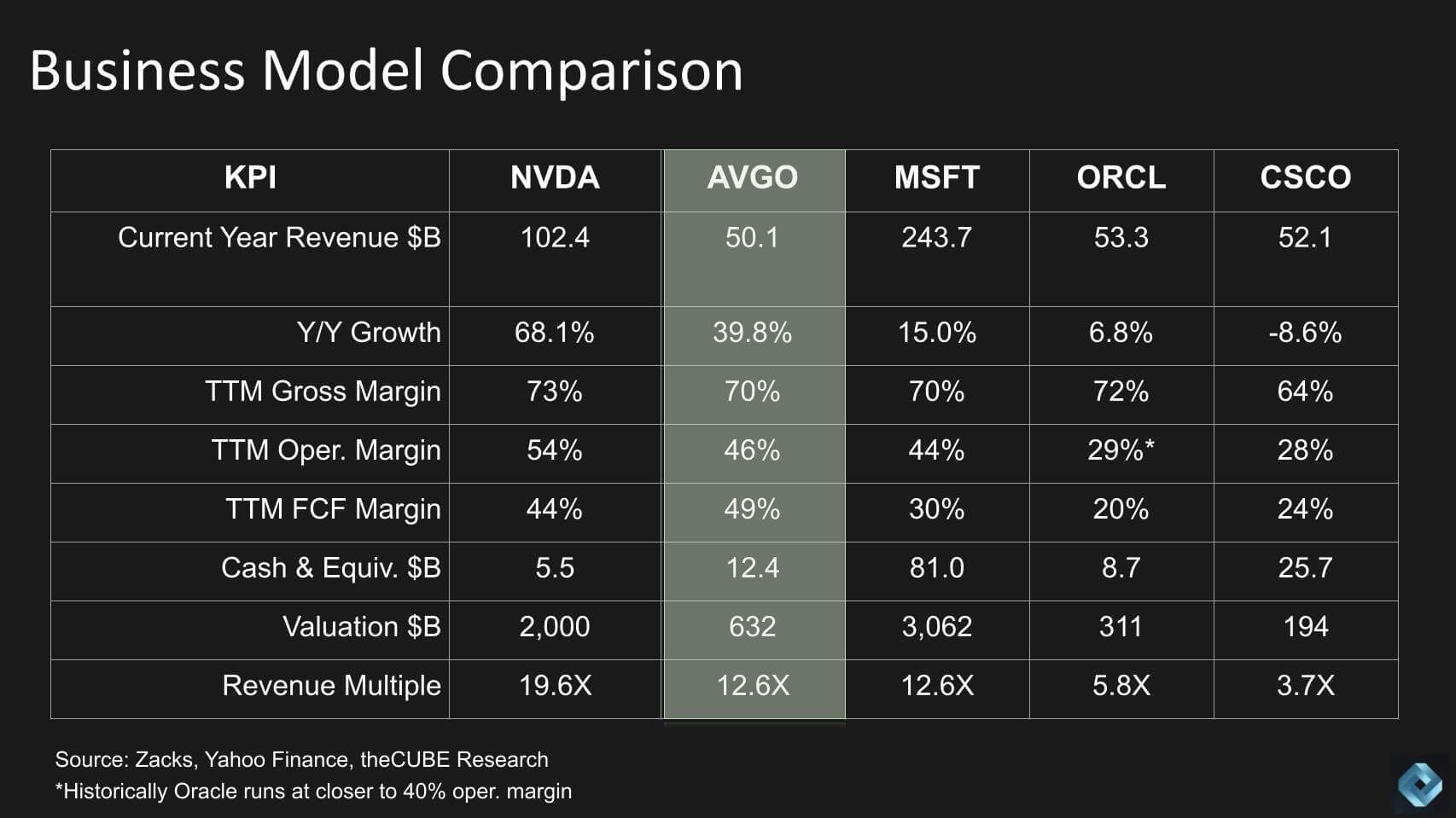

Below is a graphic that compares the financial model of Broadcom with Nvidia, Microsoft, Oracle and Cisco.

Here we show key metrics for each company including consensus annual revenue for the current fiscal year of these companies and the corresponding growth rates. Then we compare the trailing-12-month gross margin, operating margin and free cash flow margin. Then the valuation and the revenue multiple, which we sort by company in descending order. We also include some balance sheet information on cash and equivalents.

Here are the key takeaways:

Although Nvidia is a big customer of Broadcom, it’s facing off for the future of AI — not in the form of GPUs but rather in the silicon that connects the components on which AI relies to perform. And Kawwas explained over and over that Broadcom’s approach is about OSP — open, scalable and power-efficient.

We show Oracle Corp. because it is an extremely profitable software company with an infrastructure play from its cloud. And we show Cisco Systems Inc. because it’s a networking company, a bellwether and a very profitable business. But its financial model is not nearly as attractive as Broadcom’s. Few companies are as attractive as we enter this AI era.

As you can hopefully see, Broadcom is extremely well-positioned for this era, not because it is chasing the gen AI curve, but because it has a vision for a connect-centric world which happens to perfectly set it up for AI everywhere.

As such, it has become in our view the No. 2 way to play AI behind Nvidia, without having to slog it out in GPUs against the likes of Advanced Micro Devices Inc. and Intel Corp. And that’s why we call it accidental by design?

What do you think? Does Broadcom’s business model resonate with you? How do you think its network-centric and decade plus sustainable markets philosophy will play out in the long run?

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

Watch the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

THANK YOU